Eleven teams participated in a recent Stanford Energy Modeling Forum (EMF) project, examining the economic and environmental impacts of a carbon tax. The studies included “revenue recycling,” in which the funds generated from a carbon tax are returned to taxpayers either through regular household rebate checks (similar to the Citizens’ Climate Lobby [CCL] and Climate Leadership Council [CLC] proposals) or by offsetting income taxes (similar to the approach in British Columbia).

Among the eleven modeling teams the key findings were consistent. First, a carbon tax is effective at reducing carbon pollution, although the structure of the tax (the price and the rate at which it rises) are important. Second, this type of revenue-neutral carbon tax would have a very modest impact on the economy in terms of gross domestic product (GDP). In all likelihood it would slightly slow economic growth, but by an amount that would be more than offset by the benefits of cutting pollution and slowing global warming.

Meanwhile, House Republicans are again on the verge of introducing a Resolution denouncing a carbon tax as “detrimental to American families and businesses, and is not in the best interest of the United States.”

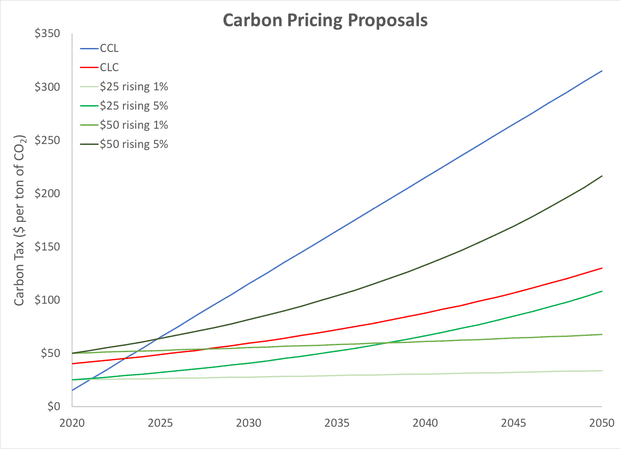

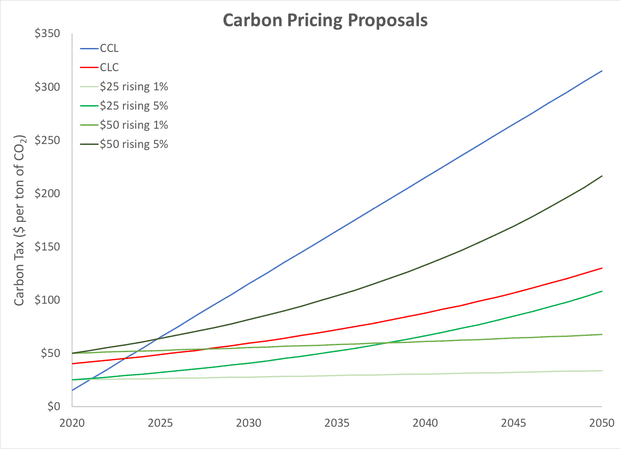

The modeling teams examined four carbon tax scenarios, with starting prices of $25 or $50 per ton of carbon dioxide, rising at 1% or 5% per year. These are somewhat modest policy scenarios; CCL proposes a starting tax of $15 per ton rising at $10 per year, and the CLC proposes $40 per ton rising around 4% per year. The most aggressive policy considered by the Stanford EMF teams ($50 per ton rising 5% per year) falls in between these two proposals.

The carbon price each year 2020–2050 in proposals by Citizens’ Climate Lobby (blue), the Climate Leadership Council (red), and the four approaches modeled by the Stanford EMF teams (green). Illustration: Dana Nuccitelli

The modeling studies consistently found that for all four carbon tax policies considered, whether the revenue is returned via rebate checks of by offsetting income taxes, the direct economic impact is minimal:

in every policy scenario, in every model, the U.S. economy continues to grow at or near its long-term average baseline rate, deviating from reference growth by no more than about 0.1% points. We find robust evidence that even the most ambitious carbon tax is consistent with long-term positive economic growth, near baseline rates, not even counting the growth benefits of a less-disrupted climate or lower ambient air pollution

The last sentence is critical. The analyses consistently found that coal power plants would be the biggest losers if a carbon tax were implemented, and the costs associated with health impacts from other pollutants released by burning coal (e.g. soot and mercury) are substantial. Phasing out coal power plants results in significant health and economic benefits to society.

So does slowing global warming, of course. A working paper recently published by the Federal Reserve Bank of Richmond concluded that US economic growth would slow by an extra 0.2–0.5% per year if we stay on our current climate path (3–3.5°C global warming) than if we meet the 2°C Paris target. This compares favorably to a less than 0.1% per year slowing of the US economic growth rate under the carbon tax scenarios.

In short, climate change will slow American economic growth. If we don’t curb global warming, the economic impact will be larger. If we implement a carbon tax to help meet the Paris climate targets, the economic impact will be negligible, and will be offset by the benefits of phasing out dirty coal power plants.

The Stanford EMF studies also consistently concluded that a carbon tax is an effective way to curb carbon pollution, especially in the power sector:

carbon price scenarios lead to significant reductions in CO2 emissions, with the vast majority of the reductions occurring in the electricity sector and disproportionately through reductions in coal … Expected economic costs (not accounting for any of the benefits of GHG and conventional pollutant mitigation), in terms of either GDP or welfare, are modest

The analyses also found that the rate of increase of the carbon tax was more important than the starting price.

Posted by dana1981 on Monday, 16 July, 2018

|

The Skeptical Science website by Skeptical Science is licensed under a Creative Commons Attribution 3.0 Unported License. |