Canada passed a carbon tax that will give most Canadians more money

Posted on 29 October 2018 by dana1981

Note: this will be our final entry on Climate Consensus - the 97%. The Guardian has decided to discontinue its Science and Environment blogging networks. We would like to thank this great paper for hosting us over the past five years, and to our readers for making it a worthwhile and rewarding endeavor.

Last week, Prime Minister Justin Trudeau announced that under the Greenhouse Gas Pollution Pricing Act, Canada will implement a revenue-neutral carbon tax starting in 2019, fulfilling a campaign pledge he made in 2015.

The federal carbon pollution price will start low at $20 per ton in 2019, rising at $10 per ton per year until reaching $50 per ton in 2022. The carbon tax will stay at that level unless the legislation is revisited and revised.

This is a somewhat modest carbon tax – after all, the social cost of carbon is many times higher – but it’s a higher carbon price than has been implemented in most countries. Moreover, a carbon tax doesn’t necessarily have to reflect the social cost of carbon. The question is whether it will be sufficiently high to meet the country’s climate targets.

Paris was a key motivator behind the Canadian carbon tax

The Preamble in the Act is worth reading. It begins by noting “there is broad scientific consensus that anthropogenic greenhouse gas emissions contribute to global climate change” (this is somewhat understated – carbon pollution is the dominant factor). It also notes that Canada is already feeling the impacts of climate change through factors like “coastal erosion, thawing permafrost, increases in heat waves, droughts and flooding, and related risks to critical infrastructures and food security.”

The Preamble also notes that in 1992, Canada signed the UNFCCC whose objectives include “the stabilization of greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system,” and that Canada ratified the Paris Agreement, whose aims include limiting global warming to less than 2°C above pre-industrial temperatures.

Canada’s Paris commitment requires cutting its carbon pollution by 30% below 2005 levels by 2030. Prior to the implementation of the carbon tax, its policies were rated Highly Insufficient to meet that goal. Instead Canada’s emissions were on track to fall only about 4% below 2005 levels by 2030. So, the carbon tax is an important policy to close that gap.

Some provinces already have carbon pricing in place

Several Canadian provinces have already implemented or plan to implement carbon pricing systems. British Columbia, Alberta, and Quebec already have such systems in place; the Canadian government noted that these provinces were “among the top performers in GDP growth across Canada in 2017.”

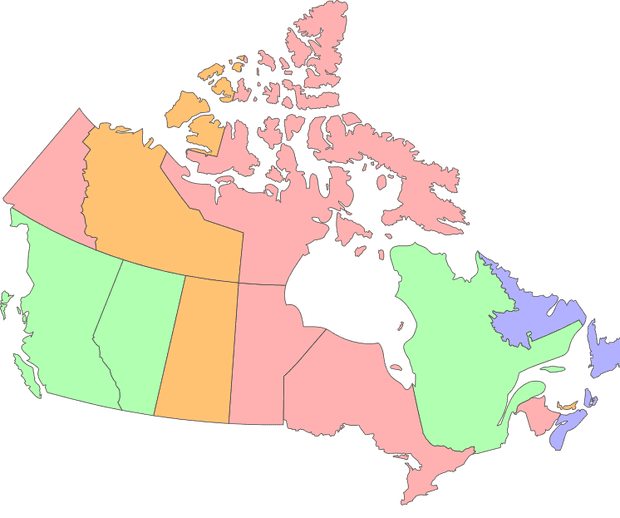

Provinces whose carbon prices meet the federal standards are already in compliance, so the new law won’t apply to them. Several other provinces (Northwest Territories, Nova Scotia, Prince Edward Island, Newfoundland and Labrador) have planned or proposed carbon pricing systems that will meet the federal requirements. The federal carbon tax will be applied to the remaining provinces.

Green indicates that the province’s own carbon pricing system meets the federal standards. Purple and orange indicate a province’s planned or proposed carbon pricing will meet the federal standards, respectively. Red indicates that the federal carbon pricing will apply to the province. Illustration: Dana Nuccitelli

Energy prices will rise

A $20/ton carbon tax translates into a 16.6 cent per gallon surcharge on gasoline. So, in 2022, the $50/ton carbon tax will increase Canadian gasoline prices by about 42 cents per gallon (11 cents per liter). For comparison, the average price of gasoline in Canada is $1.43 per liter, so that would be about an 8% gasoline price increase in 2022.

The price of coal would more than double, with a carbon tax surcharge of about $100 per ton in 2022. Natural gas prices will rise by about 10 cents per cubic meter in 2022 compared to current prices of around 13 cents per cubic meter – about a 75% increase. This will increase demand for cheaper carbon-free electricity. However, Canada already supplies about 60% of its electricity through hydroelectric generation and 16% from nuclear – only about 20–25% comes from fossil fuels.

For that reason, only 11% of Canada’s carbon pollution comes from generating electricity. The industrial sector is responsible for the biggest chunk of Canadian carbon pollution (40%). It will not be subjected to the carbon tax, but rather to an Output-Based Allocations system (similar to cap and trade).

But rebates will more than offset higher fuel costs

One key component of the federal carbon tax is that it’s revenue-neutral, similar to the policy proposal from Citizens’ Climate Lobby. All the taxed money will be distributed back to the provinces from which they were generated. The provinces will in turn rebate about 90% the revenues back to individual taxpayers. The rebates are anticipated to exceed the increased energy costs for about 70% of Canadian households.

For example, a Manitoba family will receive a $336 rebate in 2019 compared to its increased costs of $232. A similar family in Saskatchewan will receive $598 compared to its higher costs of $403. In Ontario, families will receive $300 to offset its $244 in carbon taxes. And in New Brunswick a $248 rebate more than offsets the average household cost of $202. The rebates will more than double by 2022 as the carbon tax rises, and the net financial benefit to households will grow over time.

Arguments

Arguments

Canada's carbon tax and dividend is an important policy development because taxes are a proven tool to alter behaviour, and they have stuck to the basic carbon tax and dividend policy idea rather than altering it too much, and the idea is instituted nationwide. Yes there are a couple of obvious omissions. potential criticisms, and compromises, but I think Trudeau and everyone involved deserve a lot of credit for this scheme.

It's always better to do something than nothing. Things can then evolve over time, tracking and responding to developing circumstances. However its going to have to be ramped up pretty fast given the latest concerns about warming.

It makes the USA look completely incompetent.

But Canada has to address the elephant in the room, its tar sand exports, a huge source of emissions, and the carbon tax and carbon trading scheme don't appear to impose much influence over this.

The Right-wing political groups in Canada, who like to call themselves Conservative if they can get away with it, are delivering mass misleading marketing appeals encouraging voters to believe that a Carbon Fee or Levy or tax is another 'Bad Tax (all tax is bad)'.

CBC News item "Jason Kenney, Ontario Premier Doug Ford to hold anti-carbon tax rally in Calgary"

Many people mistakenly believe that a Carbon Fee would be liked by current day Right-wing/Conservatives. The current 'United greedy and intolerant claiming to be Right' have made-up their minds to support each other's unacceptable desires. Any conservative who votes for those United Right groups will excuse denial and dismissal of climate science even if they agree with the science and the need to correct what has developed. They are more powerfully motivated by Other unacceptable personal interests that can only be conserved or imposed on society if they vote United with people who have other unacceptable personal interests.

Negotiating with such selfishly made-up minds will just end up unacceptably compromising what undeniably needs to be done. That is why one of their main claims is that they are not being heard or compromised with. And they will avoid getting into a detailed discussion where reason would end up leading to a common sense consensus. They prefer rallies of their faithful fans who are not interested in being corrected.

Tragically, those types of political animals are likely to win the leadership of Alberta in early 2019.

This recent CBC News item includes the point that polls indicate that the NDP is trailing behind the UCP.

The popularity and profitablity of unacceptable developed activity can make it very difficult to correct, no matter how correct the science is that identifies the need for correction, or how well it is presented.

"(all tax is bad)" ....Except for taxes required for fossil fuel subsidies, updated nuclear weapons, prisons for drug users, politicians air travel, their latest BMW cars...

John S, a minor supplement to your point: "I've heard the argument that it is a tax because the government gets the money and then does what it wants with it, albeit that is to give it back. And there is a view that says it would only be revenue neutral if other taxes are reduced rather than payments made."

The Conservative/Right 'call it a tax' as a deliberate election marketing strategy. They get lots of support by claiming they will cut taxes. And their history of tax cutting is to reduce taxes on the 'builders of the economy - the richest', whether they build any sustainable improvement or not with their 'extra riches and without any need for them to prove they have developed improved conditions for the rest of the population. They market their tax reductions as a benefit for everyone, but have a history of structuring them to give more benefit to a richer person than apoorer person (just like the latest USA tax changes). So their idea of 'carbon tax' off-sets to be neutral would be collecting the carbon fee from everyone, but reducing the taxes on the richest substantially more, potentially making the richer people net-benficiaries of the program while everyone else is closer to break-even or substantially losing.

One Planet … I too am leery of the tax reduction route to revenue neutrality no matter what economists say because, like you apparently, I see it as much too prone to manipulation by powerful interests; whereas a straight dividend, or Climate Action Incentive Payment, whatever it’s called, is more transparent, people know they are getting it and that everyone else is getting the same. It’s distributional and progressive because lower incomes spend less in total dollars so will incur less increases in living costs. With everyone getting the same payment, lower incomes net out higher. Then the economy will benefit because low incomes will spend the money faster. Certainly, the REMI report commissioned by Citizens Climate Lobby showed economic benefits from carbon fee and dividend. https://citizensclimatelobby.org/wp-content/uploads/2014/06/REMI-carbon-tax-report-62141.pdf

I’m going to take another shot at my point 4) since I wrote it in haste making something of a dogs-breakfast of it, mixing up different issues, and thereby failed to stress its general importance, not just to Canada.

I don’t mean to beat up on poor Dana, but he kept using “carbon tax” to refer to the Canadian federal government’s Greenhouse Gas Pollution Pricing Act. Not that he’s the only one. But in all their voluminous communications, written and oral, the feds themselves have never called it that, to the best of my knowledge (and I’ve read most of it – poor me). The legislation talks about levies and charges. And the Prime Minister and other Ministers in TV broadcasts call it pollution pricing or putting a price on pollution.

Oh yeah, but we all know it’s really a tax, right? I beg to differ. Google the meaning of the word – what comes up is “a compulsory contribution to state revenue”. The pollution price, also known as the Federal Backstop (because it applies wherever the provinces or territories have failed to enact their own carbon pricing to the federal standard) is NOT a contribution to state revenue. All the proceeds will be recycled quickly (90% to individuals as tax credits, i.e. adds to the amount a person would otherwise get back or deducts from what they owe). I’m sure many will overcome their usual procrastination and send in their tax returns as soon as they get the required documentation, which is usually in January. Thus, the carbon levies and charges will flow to us even before they have been collected (during the course of the year).

What’s in a name? Sometimes plenty. Maybe you have to be as old as I am to appreciate the significance of the following example. There was a time when news reporters refused to call the great boxer Muhammad Ali by his proper name after he converted to Islam. When sports commentator Howard Cosell introduced him by his former slave name, Ali looked hurt, asking him, “Howard, are you going to do that to me. too?”. To his credit, Cosell responded graciously “You are quite right. I apologize. Muhammad Ali is your name. You’re entitled to that.”

But in this case? If you lived in Canada, you’d know that the opposition is building up “job-killing-carbon-tax” as the issue for taking power and, as the astute political commentator Chantal Hébert concluded her column in the Hill Times today, “if next fall’s federal election does turn into a plebiscite on whether or not to try to mitigate climate change by taxing (sic – ugh!) carbon pollution, its outcome could finally put the debate to rest”. And it’s hardly going to inspire trust and confidence in carbon pricing elsewhere in the world that within the period of a little over a year three governments in Canada fell in a row, at least partly, over carbon pricing - #1 was in Ontario this summer, #2 is likely Alberta next year and the feds would be #3 if it happens.

And that would be a pity. For three decades, most economists and the odd climate scientist (James Hansen) have told us carbon pricing is the way to go. I’m sure politicians understand that but understand elections better. Now, finally, we have one willing to bite the bullet. Let it not be shot down in flames.

Will it make any difference what we call it? The feds are no doubt a lot smarter than I am and they seem to think so. And, in any case, why not call a price on pollution what it is – a price on pollution.

I think Canada's climate initiative could be most accurately called a carbon levy and dividend. A levy is technically a type of tax applied for a specific narrow purpose, or a temporary tax (time limited). The fact the money is collected and then handed back doesn't really change the fact that the money is collected. Taxes are often redistributive by nature.

The term levy has a more politically saleable sound than tax, which is useful.

It is indeed a price on carbon at one level, but that is too long a term to use.

Should it be called a fee? You could argue all day about that, and what is gained? It also starts to look like blatant spin.

However I don't think its wise to get into a public debate about how the categorise canadas carbon levy and dividend, and whether its really a tax, levy or fee, because this just goes nowhere and is negative and just stupid.

I think if people try to claim its a tax to try and put it in a negative light, and argue about it, just say no its technically a levy, but openly concede it has some features of a tax. Emphasise whats really important is how it actually works and what its trying to do. This shuts debate about terminology down, and moves things on to what really matters.

A small point, but IMHO an important if seemingly trivial one, but I think the use of "pollution" in relation to articles on carbon emissions is counterproductive.

It raises the hackles of the denial brigade, who leap into print with irrelevancies such as "plant food" etc, steering any conversations away from the point.

"Emissions" is a much more neutral moniker

Wol,

Do not allow people who deliberately evade detailed discussions that would lead to a common-sense agreement, to evade discussing the details of the issues because of their sensitivity to 'Terms'.

Try the following with anyone who questions CO2 from burning fossil fuels being pollution.

Pollution is anything produced by human activity that accumulates, changing the environment it is released into, rather than being rapidly neutralized by the recycling environment. And the more serious the consquences of the pollution the more aggressively the cause of the pollution and the clean-up of the accumulation to date needs to be.

That can be understood to apply to a very broad range of items from oil spills to silt flows into streams from deforested hillsides.

By that definition, human body wastes released gradually into an ecological system that processes it is only pollution if the rate of release exceeds the ability of the ecosystem to process it without accumulation. And human CO2 respiration releases are clearly not the same as the CO2 from burning ancient buried hydrocarbons. Human exhaled CO2 was in the recycling environment before. It is part of the developed natural recycling system.

Therefore, any increase in atmospheric CO2 due to human activity, particularly the burning of fossil fuels, and excluding human breathing because it does not increase the CO2 in the atmosphere, is "Pollution".

As for 'plant food' claims, point out that CO2 is still accumulating (a pollution) regardless of the 'term' they want to use for CO2 in the atmosphere.

Anyone who is not interested in being corrected does not deserve to be compromised with. In fact, the climate science issue has proven how damaging it can be to compromise with people whose private interests make them uninterested in being corrected. Those few scientists making up questionable claims raising doubts about climate science as a personal compromise of what they potentially better understand have been extremely damaging.

I think pollution is the correct term for CO2 emissions in a technical sense, but the public equate pollution with toxic substances like smog, and explaining why CO2 can be defined as pollution is a lengthy exercise attacked all along the way by the denialists. Is that all worth it to change a name from emissions to pollution? I'm not so sure.

But clearly its still important to discuss the processes of why fossil fuels are a problem, because its too much CO2 for natural sinks to absorb. Even if the hard core denialists are not receptive to this, it helps persuade the middle ground, and there's fulfillment in simply understanding whats going on in the world.

People objecting to the pollution of CO2 from burning fossil fuels being called "Pollution" could also be asked if they have also disagreed with (acted in the past to express dislike for) the terms "Noise Pollution" and "Light Pollution (that damaging effect on Dark Sky regions)".

The "Enigma of Reason" by Hugo Mercier and Dan Sperber presents a good case that everyone is capable of understanding what is justified by Reason, but will be tempted to allow a personal interest to keep them from being reasonable.

A very powerful motivation for people to disagree with climate science is the fact that actually accepting or understanding it lays bare the indefensible claim that 'people being freer to believe what they want and do as the please in competition for appearances of superiority relative to others will develop Better Results'. The responsibility to develop sustainable improvements for future generations and not harm others justifiably limits freedom, even if a person can claim that 'The previous generation did not treat them fairly, so why should they care about the future?'.

The cycle of inflicting harm on future generations has to end, the sooner the better for the future of humanity.

Some people simply do not like the idea of being corrected, especially if their developed perception of enjoyment of life would be severely compromised by being corrected. And the ones profiting from the incorrectly developed enjoyments of life are more powerfully motivated against being corrected. But none of that changes the understanding of the required corrections.

One Planet Only Forever @ 9:

In a logical and technical sense I agree fully with what you say. But I am talking about the psychology of deniers' arguments (such as they are.)

As nigelj says intimates above, is it worth US agreeing about the strict meaning of a word if the use of one word against another allows anyone to divert a logical argument towards semantics?

Enough.

OPOF @11

OPOF, I have to agree with Wol @8. Carbon pollution is not the best term to try to use, and emissions is fine. Its an issue that really bugs me as well.

I personally think you are of course essentially right in theory that its pollution, and about people not liking the truth, but trying to convice everyone to label carbon emissions as carbon pollution might a battle not worth fighting. You have to loose a few battles to win the war.

There are so many downsides to promoting the term pollution for so little gain.The counter arguments like CO2 is plantfood are endless and will take up a lot of time. It soaks up energy that is better put into discuusing the general fatcs, motivating change and reducing emissions. It will put huge attention back onto the denialists, and will never convince the right wing, who probably don't believe noise is pollution either in many cases.

It's a giant can of worms better not opened. Its rearranging deckchairs on the Titanic.

Definitions are important things, but we can end up going around in circles as well. Whats important is underlying cause and effect and talking about that.

nigelj and Wol,

I do not share your optimism that people who are 'upset' about CO2 being called 'pollution' will accept it being called 'emissions' and agree to correct their incorrectly developed preferences for benefiting from the burning of fossil fuels.

The term 'emissions' does not carry a clear implication of unacceptability the way pollution does. Therefore, it does not relate as effectively to the need to correct what has developed. Therefore, calling it emissions makes it easier to dismiss the need to do anything about it (and The Enigma of Reason makes it pretty clear that people can be very easily impressed into 'not changing their mind')

But I agree, rather than getting into a discussion about terms, we should all be able to agree that what has developed, the popularity and consequences of burning fossil fuels, is unacceptable and needs to be corrected and cleaned up 'by the current generation', particularly by the ones who got the most benefit from making the mess that has been made and is continuing to be made worse. (hopefully no objectionable terms have been included in that statement)

Scientists can technically refer to the CO2 from burning fossil fuels as emissions from the burning of fossil fuels.

Leaders should call things what they are to be clearer about their acceptability, while still being technically correct. The term Pollution applied to CO2 from burning fossil fuels is well suited for that purpose. And a political discussion where someone tries to politically say it isn't pollution is a perfect opportunity to make it clear that they are politically and technically incorrect.

Paraphrasing what Steven Pinker says in "Enlightenment Now", some people will not be pleased to have the reasons that their beliefs are incorrect pointed out, but correcting incorrect beliefs is human progress, and human progress is the future of humanity.

"Making Polluters Pay" is a punchy and defensible selling point regarding actions to curtail the creation of more CO2 from fossil fuels (technically and politically correct).

Some people will not like it, but it is undeniably harmful to try to please those type of people.

I can foresee many people asking the obvious question; If renewables are cheaper, why is it necessary to have a carbon tax or levy etc ?

The tax being proposed in canada appears to be similar to the one implemented in Australia in 2010, which was employed as a means of redistributing wealth as much as it was to mitigate emissions. It looked good on paper and should have wooed voters of the working and lower-middle classes, but ultimately it was a political disaster and hasn't been revisited.

Art,

We want to install renewables as rapidly as possible. With a carbon fee that incentivizes people that much more.

Because so many big companies have sunk assets in fossil fuels they are resistant to investing in renewables even when renewables are cheaper. That is why they fund denial. A carbon fee will make it easier to overcome that institutional resistance.

In any case, why should fossil fuels be allowed to pollute the atmosphere for everyone for free?? They should have to pay for the damage they do.

Fossil fuel companies are currently trying to get the Republicans to pass laws so that they cannot be sued for the damage they have caused with their pollution. People who lose their homes to climate change should be able to sue Exxon and BP for their losses. Why should fossil fuel companies get to keep the profits and make us pay all the damage?

Art Vandelay @17, fair point that Australia's Carbon tax had some problems, and political policies were a big part of this, but its worth digging a little more on just why it failed. Most of these failings were unique to Australian politics and personalities, and can be avoided in other countries and appears they are. So don't read too much into Australias scheme. The principles were largely not wrong, it was more mistakes in execution.

It was also not a carbon tax and dividend scheme. Instead there was an income tax cut, - but perhaps people didn't believe they were even getting a cut. A dividend is much more visible and should work better.

I'm not seeing any obvious evidence that it was intended to be socially redistributive as such but perhaps this was in the way they structured the income tax bands. I don't have a problem with some income redistribution as an ideology, but I think it should be kept separate from the climate tax issue if its going to be politically contentious and could stall passing the legislation.

Quick history of the key points cobbled together:

The Australian government introduced a carbon pricing scheme or "carbon tax" through the Clean Energy Act 2011. The initiative was intended to control emissions in the country, as well as support the growth of the economy through the development of clean energy technologies. It was supervised by the newly-created Climate Change Authority and the Clean Energy Regulator. However, although it did achieve a reduction in the country's carbon emissions, the initiative faced significant challenges from the opposition and the public, as it resulted in increased energy prices for both households and industry and was finally repealed in 2014.

When Julia Gillard took over as leader of the Labor Party in 2010, she solemnly swore not to impose a carbon tax. Then she formed a coalition with the Greens and promptly broke her promise. The carbon tax was introduced two years ago, and people hated it from the start. They threw the Labor Party out of office and elected Mr. Abbott, who promised to "axe the tax."

A carbon pricing scheme in Australia..... As a result of being in place for such a short time, and because the then Opposition leader Tony Abbott indicated he intended to repeal "the carbon tax", regulated organisations responded in a rather tepid and informal manner, with very few investments in emissions reductions being made.[2] The scheme was repealed on 17 July 2014, backdated to 1 July 2014. In its place the Abbott Government set up the Emission Reduction Fund in December 2014.

As part of the scheme, personal income tax was reduced for those earning less than $80,000 per year and the tax-free threshold was increased from $6,000 to $18,200.

So its a lesson in how to not introduce a carbon tax. Im sure other countries can learn and do it better.

Thanks @nijelj for the points summary. The tax did impact negatively on a large proportion of the middle class, and coming out of the GFC was not the most optimum timing either, so its demise was not entirely unexpected.

Having said all that, is a CT really necessary if the government is already subsidising renewables and imposing reasonably ambitious targets for emissions - as is the case in Australia? When the tax was introduced it also created a new level of gov't to administer it, and inevitably money was wasted in the process. Interestingly, in Australia, Labor in opposition is well ahead in the polls at the moment and a big part of their platform is far more ambitious emissions reductions targets in the energy and transport sectors. Maybe this means that people actually want a carbon tax now, but perhaps an alternative would be to allow citizens to donate to a climate fund with conditions similar to charitable donations, empowering those who wish to do more, to do more.

Art Vandelay @20

"The tax did impact negatively on a large proportion of the middle class, and coming out of the GFC was not the most optimum timing either, so its demise was not entirely unexpected. "

How much negatively? If they were getting income tax cuts, this must have reduced the impacts.

"Having said all that, is a CT really necessary if the government is already subsidising renewables and imposing reasonably ambitious targets for emissions - as is the case in Australia? "

The trouble is subsidies only work for a few things like electricity generation. You also have to deal with a range of other things like transport fuels, industrial emissions, agriculture that don't ideally suit subsidies. Some do, some don't. You really need a price on carbon that is universal, and then a universal mechanism like a carbon tax or emissions trading scheme. Economists favour the former, although either can work in theory and its not a lot between them. Then subsides can really be used as well, for the small number of things that aren't dealt with well by the tax. Rather than the other way around.

The bottom line is this. During the period when Australia had a carbon tax, emissions did fall for several years, and since that period they have increased despite much hand waving and goal setting and some subsidies related to the electric grid. I'm a person driven by evidence and results. This all points strongly in favour of a carbon tax. It's been the same in the UK.

"Maybe this means that people actually want a carbon tax now, but perhaps an alternative would be to allow citizens to donate to a climate fund with conditions similar to charitable donations, empowering those who wish to do more, to do more. "

It's hard to see how such a climate fund and donation scheme would work well. It would certainly be administratively complex, a criticism you make of a carbon tax (somewhat unfairly because its a simple enough tax). In addition it would presumably be subsidising various things, but thus runs into the problems I mentioned above, that it will be hard to target everything and it lacks a price on carbon. The tax rebate erodes the tax base. Income could fluctuate unpredictably. It's not a bad idea, but its far from a particularly good or practical idea.

The level of the carbon tax is far less important than the fact that it increases each year by some predetermined formula. Trudeau could have started with a far lower tax but with an arithmetic (X1,2,3,4...) or geometric (X1,2,4,8,16....) formula for increasing the amount year by year. It is sad that he put a cap on the maximum amount. An open ended price would have sent investors scrambling to get out of carbon based fuel and into renewables befor they lost their shirts. It would have happened long before it was strictly economically necessary.