Declare energy independence with carbon dividends

Posted on 5 July 2018 by Guest Author

Taking action on climate is about a lot more than our energy economy. Climate disruption is the leading threat to our built environment, an accelerant of armed conflict, and a leading cause of mass migration. Its effects intensify and prolong storms, droughts, wildfires, and floods — resulting in the US spending as much on disaster management in 2017 as in the three decades from 1980 to 2010.

Out of control wildfire approaching Estreito da Calheta, Portugal. September 2017. Photograph: Michael Held

Fiscal conservatism and national security require a smart, focused, effective solution that protects our economy and our values.

Political division between the major parties in Washington has left the burden of achieving that solution largely on Democratic administrations using regulatory measures that — for all their smart design and ambition — cannot be transformational enough to carry us through to a livable future.

Conservatives say the nation needs an insurance policy. Business leaders want to future-proof their operations and investments. Young people are demanding intervention on the scale of the Allies’ efforts to rebuild Europe after World War II.

The International Monetary Fund — whose mission is to ensure national dysfunction doesn’t undermine the solvency of public budgets and lead to failed states — warns that nations that depend heavily on publicly subsidized fossil fuels are endangering their future solvency by investing in a way that destroys future economic resilience. Resilience intelligence requires diversification and innovation on a massive scale.

The rapid expansion of green bonds is making clear the deep need for clean economy holdings among major banks and institutional investors. Climate-smart finance, still a new concept, is expected to be the standard for both public and private-sector actors at all levels within 10 to 20 years.

Republican former Secretaries of the Treasury James Baker and George Shultz have called for a carbon dividends strategy, because:

- it avoids new regulation,

- it abides by conservative principles of market efficiency, and

- it leverages improvements to the Main Street economy to ensure a future of real energy freedom.

Main Street economies suffer when too much of the money in circulation flows to finance, without clear incentives to lend to small businesses. The steadily rising monthly carbon dividend makes sure more of the money in circulation flows through small businesses, locking in that incentive and making the whole economy more efficient at creating wealth for the average household. Photograph: Joseph Robertson

Unpaid-for pollution and climate disruption limit our personal freedom and then, by adding cost and risk to the whole economy, undermine our collective ability to defend our freedom and secure future prosperity. Even with record oil and gas production, the US still depends heavily on foreign regimes hostile to democracy that manipulate supply and undermine the efficiency of our everyday economy.

Energy freedom means reliable, everywhere-active low-cost clean energy, answering the call of expanded Main Street economic activity.

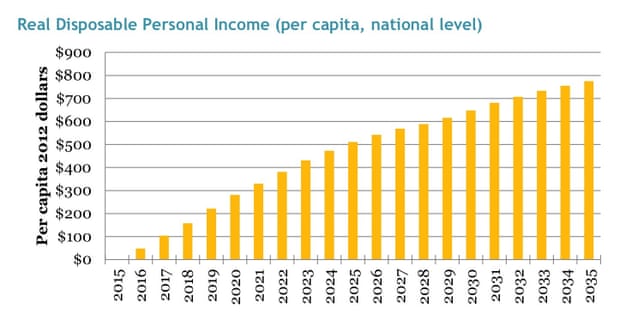

A study by Regional Economic Models, Inc., which modeled the interacting economy-wide impacts of monthly household carbon dividends found real disposable personal income rising for at least 20 years after the first dividends show up in the mail. Details at http://CitizensClimateLobby.org/REMI-Report Illustration: Regional Economic Models, Inc.

Ask any small business owner if they would rather have higher or lower hidden business costs built into everything they buy from their suppliers. Of course, they would prefer lower hidden costs and risks, and for consumers to have more money in their pockets.

That is how carbon dividends work.

- A simple, upstream fee, paid at the source by any entity that wants to sell polluting fuels that carry such hidden costs and risk. This is administratively simple, light-touch, economy-wide, and fair to all.

- 100% of the revenues from that fee are returned to households in equal shares, every month. This ensures the Main Street economy keeps humming along.

- Because both the fee and the dividend steadily rise, pollution-dependent businesses — and the banks that finance them — can see the optimal rate of innovation and diversification to liberate themselves from the subsidized pollution trap. The whole economy becomes more competitive and more efficient at delivering real-world value to Main Street.

- To ensure energy intensive trade-exposed industries are not drawn away by other nations keeping carbon fuels artificially cheap, a simple border carbon adjustment ensures a level playing field, while adding negotiating power to US diplomatic efforts, on every issue everywhere.

Arguments

Arguments

A carbon tax and dividend scheme clearly has huge merits. But what's to stop people spending the dividend cheque on petrol, cancelling the point of the scheme? I think you have to use part of the tax revenue to subsidise electric cars and renewable electricity generation, to make this as attractive as possible, and this should be acceptable to conservatives, as it keeps the money away from general state spending.

It's rather hard to see how a carbon tax would deal with creating agricultural carbon sinks or new forests. So no sorry I dont see a carbon tax as a "stand alone solution", but at the same time you would not need many additional measures, possibly just a few limited subsidies. If fossil fuel subsidies were cancelled, this would pay for part of electric car subsidies anyway.

But subsidies should be spread equally over all forms of clean energy, and generating companies should make the choice on the best form of generation rather than government. This would presumably resolve conservatives worries about government over reach.

nigelj: You're rather missing the point. The important bit is that the petrol will cost more than it does now. Yes, people can just spend the dividend on the petrol, but this means people who can't afford the capital expenditure currently needed to buy solar panels or whatever other type of clean energy are not penalized. Those of us who can, will. And with a reasonable sized carbon tax, renewable energy will be cheaper than fossil energy in all cases, without further incentives. Thus anyone who has the ability to make the choice will choose renewable.

Sure, you can just go about as you were, getting money back and using that to offset the higher cost of petrol. Or you can switch to renewable energy, which is now cheaper than fossil, and spend the rest of your rebate on whiskey and chaw (or however you prefer to spend your extra cash).

The idea is this will drive investment in renewable energy, which of course it will, and that will accelerate the continuing drop in cost of renewables. It may or may not be sufficient, but given how fast the costs have dropped recently, I'm willing to believe it would be.

Vector @2, yes I appreciate all that, and I didn't say a carbon tax and dividend idea was a bad thing. I was simply making the point that we could resolve the problem I mentioned by making electric cars more attractive with a subsidy. Currently they aren't "cheaper" than the alternatives. Do you have any ideological objection to a subsidy, or something?

nigelj,

I share your understanding that making fossil fuels more expensive through a 'levy that is fully rebated to the entire population' would not bring about the required rapid end of their use, particularly among the wealthier portion of the population. The already more fortunate humans, the ones who can afford to just keep on buying fossil fuels (and can actually afford to most responsibly transition away from benefiting from burning fossil fuels - can afford a Tesla), know they would get some of the extra cost back in a rebate.

What was done in Alberta (Alberta Carbon Levy and Rebate) is more effective. About half of the total collected Carbon Levy (a more appropriate term to use when the collected money does not go into General Revenue) is rebated to everyone earning less than a middle income (household earning less than $95,000, individuals earning less than $47,500.

The remainder of the collected levy is used to do targeted encouragement and support of the type of changes that need to be developed (what you indicate also needs to happen).

That program makes the wealthier people more wary of just carrying on the way they want 'because they can afford it'. As the levy increases they would appreciate they would get significant personal benefits from behaving more responsibly (dumping the Hummer).

OPOF, yes thats exactly the sort of thing I mean. A carbon tax, but with some of the levy as targeted encouragement.

Well I have close to ideological objection to subsidy. Picking winners when several horses in the field. Carbon tax and dividend gives wins to all competitors against carbon including public transport, cyclists and who knows what tech down track.

scaddenp,

Review the Alberta plan in the link I included in my comment. It indicates what the non-dividend levy is directed towards, including spending on transit and the reconfiguring of roads to reduce car lanes to include safer bike lanes. It is not trying to 'pick winners'. It is supporting the transition to alternatives to burning fossil fuels and improving energy efficiency.

However, I would support a version closer to what you are indicating. A larger portion of the collected levy rebated, but still only given to the lower income portion of the population.

The richer people can afford to behave better. They always have been able to behave better. Many of them just choose not to, because doing so would reduce their ability to be richer (they would still be richer, just not as richer as they could be). Their lack of interest in leading the transition to better behaviour needs to be corrected. They need to be encouraged to change their minds.

OPOF, I approve of Alberta's plan on whole and long term I would think more effective than subsidies on buying electric cars. I think the rich are more of problem than poor, because while they can afford to buy electric cars and poor cant, they can also afford SUVs, diesal central heating, regular air travel etc. The old I=PAT formula. When carbon pricing bites, its the low-carbon version of anything that should be the cheap affordable option.

The other way I like making the expensive capital items associated with property affordable (solar heating, PV, insulation etc), is loans paid back through rates.

Nigelj: I usually enjoy your (admirably frequent) comments and find myself in agreement with you 90% of the time. On this occasion, Vector@2 was justified in saying you are missing the point about carbon fee and dividend. I’ll try to explain it. You noted people could spend the dividend on petrol and that would cancel the point of the scheme and that problem could be resolved by using part of the revenue to subsidize electric cars (EV’s).

But the point of the scheme goes way beyond end consumers buying petrol. It would affect every nook and cranny of the economy. And not returning all the revenue to citizens would undermine long-term political viability. As an illustration of the latter problem, here in Ontario we have a new government that says the first thing it will do is scrap the Cap-and-Trade scheme that was brought in by the previous government. Alberta, in fact the whole country, may soon face the same as there are opposition leaders who say they will “axe-the-tax” (their words). I believe a carbon tax in Australia was rescinded.

Do I even have to ask why a carbon tax is almost universally unpopular? (Hint: it includes the word “tax”). To further make this point, let me give you my perspective. Like many city dwellers, I don’t even own a car and rent an apartment. These are my preferences; but, in any case, I can’t afford to buy a house, or run a car, on my meagre retirement income. So how do you think I would feel about my tax dollars subsidizing much more affluent individuals who can afford EV’s or put solar panels on their lovely big houses? It’s a reverse Robin Hood. Plus, EV’s don’t necessarily help in areas where the grid is high carbon and solar panels don’t in areas where the grid is low carbon (like here in Ontario).

In the words of George Shultz, “it’s not a tax, if the government doesn’t keep the money”. You’re wrong to suggest that ear-marking the funds for specified green projects will satisfy a lot of people. It doesn’t alter the fact that the government is still making the decision about what to spend the money on and a lot of us simply don’t trust it to make sensible decisions (in this area), and with good reasons, which are obvious from a review of the Ontario Auditor General’s critique of Ontario’s Climate Action Plan to be funded from the proceeds of selling allowances under Cap-and-Trade.

Let investment decision be made by those who know their industries, who have (figurately speaking) dirt beneath the finger-nails type experience of actually making physical things work, who have skin in the game. These are those who will be encouraged to invest in making available low carbon products and services when they see how high the carbon fee is going to go because they’ll see they have a chance of competing with fossil fuels when the carbon fee is high. And it can’t, politically, go high enough if it is a tax.

It’s a truism that, initially, motorists will continue buying more or less the same volume of petrol, especially if they use the car mostly for commuting to work. They’ve just got to get there and in the early years the carbon fee doesn’t increase the pump price to an extent that will overly bother many people. But a large part of the point is the affect of increasing prices not so much on the short-term purchasing decisions of end-consumers but rather on the long-term planning decisions of the commercial interests planning what type of cars to manufacture. As a case in point, Sweden has a carbon tax of about $200/tonne. Can it be totally unrelated that Volvo will not manufacture any more petrol driven cars?

A broader point I’m glad you’ve given me the opening to express is that reductions in greenhouse gases will be to a large extent the result of commercial, not consumer, decisions. For example, what type of car to manufacture, how to make steel, how to make cement, how to make fertilizers, whether to develop a district heating system, how to design a major commercial building complex. These include public-sector decisions like whether to expand transit, how to handle solid waste etc. Long-lead time, capital intensive decisions will be affected not only by the contemporaneous carbon fee, but much more so by the carbon fee expected in future years.

Hence the value of continually increasing the fee every year. For example, currently, in Canada the fee increases 10$ per tonne each year. But there is so far no commitment to continue increasing past $50/tonne. That’s a crucial mistake. $50/tonne will still not get the gas (petrol) guzzlers off the road (although it will shut-down coal fired power stations). The fee should continue to increase until the goal of near zero emissions is achieved. And such future increases can be virtually carved in concrete politically by way of the popularity of the dividends. Once those Electronic Funds Transfer amounts start appearing every month in everybody’s bank accounts or debit cards, people will build their household budgets on them and no future politician will dare to mess with them. We will enjoy policy stability. That, above all, is what is craved by business, to get on with the transformation. That’s the point.

John S @9, ok I accept adding subsidies for electric cars wasn't a great idea. I'm planning on purchasing one fairly soon, and perhaps this was subconsciously colouring my view.

Just to be clear on my position: I completely 100% support carbon 'fee' and dividend, and have done for some considerable time, more or less for the reasons you have outlined, and it was just the details of how it is implemented that concerned me on whether all or some of the levy should go into the dividend.

But I would add these points to think about:

Theres also the psychological issue with electric cars. Carbon fee and 100% dividend makes them pretty viable if you do the maths, but who does the maths? I suspect electric cars will need to be more competitively priced to really take off.

Maybe its best to keep the carbon fee and dividend scheme simple and with a 100% dividend for practical and political viability purposes. But it could also be a decision for individual countries, and in America a purist scheme would probably be the only politically acceptable thing, but Alberta in Canada appears to have a scheme that uses part of the levy to fund a range of projects, and perhaps this is what the population wanted?

And heres a problem for you. Electric cars rely on a network of recharging stations, and the economics of recharging stations rely on a significant volume of electric cars, so implementation of recharging stations has sometimes been slow. A carbon levy would resolve this over time, but I suggest it would be a slow process. It still seems it would need some form of subsidy, perhaps funded in another way other than from the carbon levy?

I'm aware of the danger of governments subsidising things and picking winners, however there's a pretty obvious economic case sometimes, provided the decisions are kept out of the hands of politicians as such, and are made by some state agency, and are based on recognised market failures. We subsidise science research for example, and the film industry to attract projects to our country, and it has worked well. I confess I'm a bit of an "economic pragmatist".

Much of the wind power in the UK and Europe has been funded with subsidies. I doubt it would have been built without something like this. However the base prices of wind and solar power have dropped so much I suppose subsidies are not as necessary now, and a carbon levy and dividend could possibly replace this. It would however need to be carefully analysed.

#9 John S ― Your points are all well taken. In particular, regarding embedded carbon emissions.

nigelj ― Like others, I value your thoughts, how you express them, and the regularity of your offerings. This time I disagree heartily… but respectful disagreement and debate are famously effective.

Separately, there is another (and major) advantage to a wisely implemented US carbon tax (I prefer to call it a "tax" instead of some euphemism). It has to do with worldwide CO₂ emissions. Refund the carbon tax embedded in US exports. Apply this to imports, in proportion to what the foreign exporter's country has NOT CO₂-taxed and hence is NOT embedded in the cost of his product. In view of the massive imports entering the US, foreign countries would certainly find themselves loath to see money they could collect as revenue ending up in the US Treasury and not in their own.

Thus (shades of Iosev Jughashvili!), we could have "Control of Global Warming in One Country!"

Dcrickett, thank's for the comments. I agree about exports.

I will support carbon fee and dividend (all given to consumers) because it's the only thing likely to get enough political support in America, and its at least a good scheme.

However I still have some doubts about how the carbon fee is ideally best spent / handed back, and whether it can totally substitute for regulations, but as I said different countries can and probably will fine tune the scheme. I have just done a google search, and my views are not unique. I think you guys are wrong to dismiss subsidies in principle, or philosophically.

Some interesting debate on J Hansens carbon fee and dividend scheme. I I just found this with a random search, and I don't support all that's written there.