Keystone XL: Oil Markets and Emissions

Posted on 1 September 2014 by Andy Skuce

-

Estimates of the incremental emission effects of individual oil sands projects like the Keystone XL (KXL) pipeline are sensitive to assumptions about the response of world markets and alternative transportation options.

-

A recent Nature Climate Change paper by Erickson and Lazarus concludes that KXL may produce incremental emissions of 0-110 million tonnes of CO2 per year, but the article has provoked some controversy.

-

Comments by industry leaders and the recent shelving of a new bitumen mining project suggest that the expansion of the oil sands may be more transportation constrained and more exposed to cost increases than is sometimes assumed.

-

Looking at the longer-term commitment effects of new infrastructure on cumulative emissions supports the higher-end incremental estimates.

President Obama (BBC) has made it clear that the impact of the Keystone XL (KXL) pipeline on the climate will be critical in his administration’s decision on whether the pipeline will go ahead or not. However, different estimates of the extra carbon emissions that the pipeline will cause vary wildly. For example, the consultants commissioned by the US State Department estimated that the incremental emissions would be 1.3 to 27.4 million tonnes of CO2 (MtCO2) annually. In contrast, John Abraham, writing in the Guardian (and again more recently), estimated that the emissions would be as much as 190 MtCO2 annually, about seven times the State Department’s high estimate (calculation details here).

The variation in the estimates arises from the assumptions made. The State Department consultants assumed that the extra oil transported by the pipeline would displace oil produced elsewhere, so that we should only count the difference between the life-cycle emissions from the shut-in light oil and those of the more carbon-intensive bitumen. In addition, they estimated that not building KXL would mean that bitumen would instead be transported by rail, at slightly higher transportation costs. Abraham simply totted up all of the production, refining and consumption emissions of the 830,000 barrels per day (bpd) pipeline capacity and did not consider any effect of the extra product on world oil markets.

Neither set of assumptions is likely to be correct. Increasing the supply of any product will have an effect on a market, lowering prices and stimulating demand (consumption) growth. Lower prices will reduce supply somewhere. The question is: by how much?

An interesting new paper in Nature Climate Change (paywalled, but there is an open copy of an earlier version available here) by Peter Erickson and Michael Lazaruares ,attempts to answer this question. The authors are based in the Seattle office of the Stockholm Environment Institute (SEI).

"Impact of the Keystone XL pipeline on global oil markets and greenhouse gas emissions"

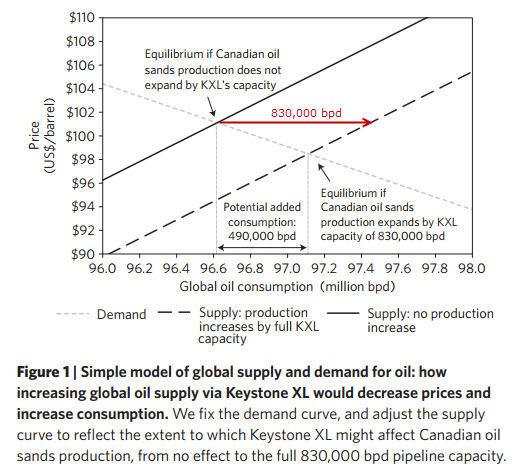

Erickson and Lazarus (E&L) use a simple economic model to estimate the effect of adding 830,000 bpd of bitumen to world oil markets. Other things being equal—but with oil they rarely are, see later—increased supply will lead to lower prices and those lower prices will lead to lower supply and higher demand, until the market clears. This is illustrated in the graph from their paper, below (I added the red arrow and text).

The supply curve (sloping up to the right) is shifted rightwards by the extra 830,000 barrels of oil per day, which is the capacity of the KXL pipe. Production falls elsewhere by 340,000 barrels to meet the demand curve (which slopes up to left). The additional supply of oil sands oil effectively adds a net 490,000 barrels of supply to the market. This is a ratio of 0.59 extra barrels consumed for every additional barrel supplied. Demand increases as prices fall by about $3 per barrel.

As should be obvious, everything in this analysis depends on the slopes of those curves (they are actually here, of course, straight lines and the gradients are related to "elasticity": the more elastic the demand or supply, the flatter the lines).

E&L considered different estimates of elasticities for supply and demand, sourced from published surveys and an OECD review. They found from this sensitivity analysis that the variation in the 0.59 ratio figure (global consumption increase divided by oil sands production increase) ranged from 0.08 to 0.78.

If it is assumed that the construction of KXL results in an additional 830,000 barrels per day of bitumen on the world market, then the extra global emissions due to pipeline are in the range of 100-110 MtCO2/year, an amount about halfway between the State Department’s and Abraham’s estimates. On the other hand, if the pipeline only carries product that otherwise would have been shipped by other means, the incremental impact would be zero.

Controversy

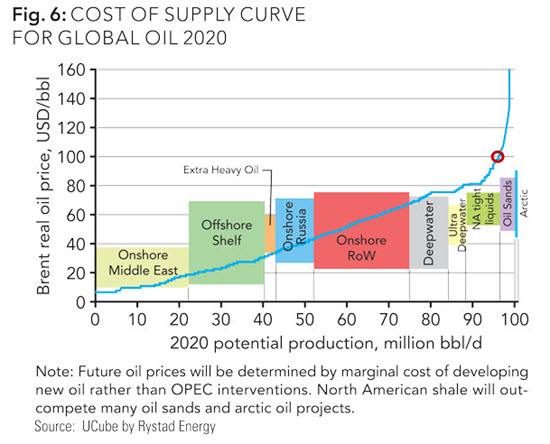

There has probably not been a single opinion expressed on the KXL project that has not been hotly disputed and E&L’s paper is no exception. Energy economist Michael Levi [link] has made three criticisms. First, he disputes their assumption of perfect world markets in oil that make the problem amenable to simple modelling, pointing to the still strong influence of OPEC and other large state producers. Second, he challenges the supply elasticity assumption E&L have made, arguing that the estimate is highly uncertain and that the uncertainty range on the low elasticity side is too low. See the graph below.

Source A simplified version of this curve can be found in E&L's Supplementary Information. The red circle (added) marks the assumed equilibrium price at a consumption level of 96.62 mbpd in 2020.

Finally, Levi raises questions about the effect that KXL will have on oil sands production. At lower oil prices, at which the extra cost of rail transport would have an impact on the profitability, the supply curve would also be flatter, diminishing effects of additional production on prices and demand.

In response, E&L admit that their simple model has limitations and that politics and cartel behaviour are hard to predict using any simulation. But they say that their model has the virtue of transparency and that it is easy to use it to calculate uncertainties and explore different scenarios. They also acknowledge uncertainty on the estimation of supply elasticity and say that that was why they modelled the sensitivity in their paper, but they stand by their central estimate. On the last point, E&L point out that the range of their conclusions (0-110 million t CO2/yr) already covers the case of KXL having no effect on oil sands production. From their abstract:

As a result, and depending on the extent to which the pipeline leads to greater oil sands production, the net annual impact of Keystone XL could range from virtually none to 110 million tons CO2 equivalent annually.

Energy economist Andrew Leach also discusses the economics of the rail option in the context of the E&L study. He points out that the oil sands development proponents assure us that the economics of the rail option are robust, even if this adds a few dollars per barrel to the costs. However, the same proponents often claim that carbon pricing that would add a few cents per barrel would threaten the competitivity of the oil sands. For example, see this article by journalist Aaron Wherry. Moreover, Dave Sawyer of IISD points out that the cost of doubling Alberta's current carbon tax would add the cost of a Timbit (left as a Googling exercise for the non-Canadian reader), about 13 cents per barrel, yet even the introduction of this small extra fee is contested by industry lobbyists and by politicians and is unlikely to be introduced.

Even though E&L’s model has provoked some harsh criticism, it is the only peer-reviewed article that attempts to model an important consequence of one of the most contested environmental decisions in North America. The onus is surely on their critics to provide a better model.

A criticism of my own is that, in the particular case of KXL, there will not be 830,000 barrels per day of additional bitumen delivered to markets. (E&L used 830,000 bpd to facilitate direct comparison with the State Dept numbers.) The fluid in the pipeline will be diluted bitumen, which will be about 25% light oil or condensate. This fluid will be separated out at the refinery and will be recycled or used for other purposes and should not be considered as new oil put on the market as a result of the pipeline. The maximum emissions that KXL could be responsible for in E&L’s analysis would therefore be in the range of 75-80 Mt CO2/year.

It is worth noting that E&L's calculation that an extra supply of 830,000 bpd will produce a commodity price drop of $3 per barrel is at odds with claims of many opponents of the pipeline, who assert that the increased oil sands production will make no difference at the gas pumps.

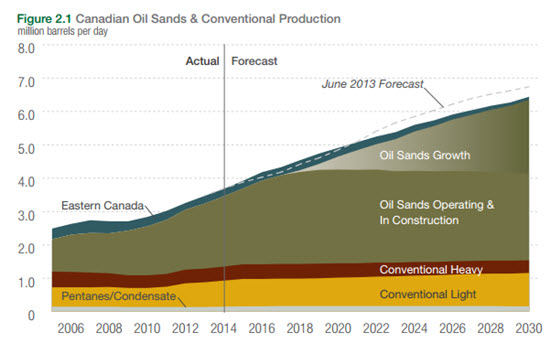

KXL is only part of the oil sands expansion story. According to the Canadian Association of Petroleum Producers, production will grow by about four times the amount of the volume of KXL. If E&L's methodology is to be accepted, this would cause a world crude price drop of $12 per barrel.

My personal assessment is that by applying incremental analysis methods the additional emissions resulting from the construction of KXL will more likely be in the lower half of E&L's range of 0-110 M t CO2/yr. This is in part due to the supply elasticity concerns raised by Levi, the role of transportation alternatives recognized by everyone, and a reduction of about 25% due to the diluent content of the fluid in the pipeline.

Nevertheless, I think that the issue can be looked at in an entirely different way, one that can allow us to consider that the emissions impact of a KXL approval could even be bigger than the carbon that might flow through the pipe.

Good to the last drop

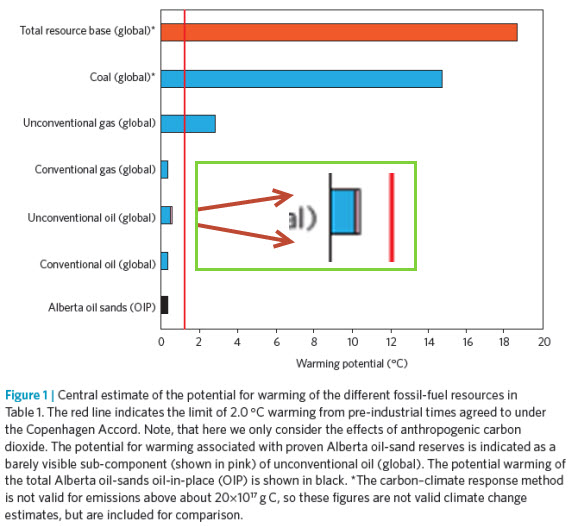

Climate scientist Ray Pierrehumbert points out that for long-lived greenhouse gases like CO2, what matters is the cumulative amount emitted. The timing of emission has almost no effect on the ultimate warming effect and the climatic consequences will persist for many thousands of years. Deferring emissions for a few decades brings us almost no benefit.

As many scientists (e.g. Allen et al. 2009) have noted, we have a limited carbon emissions budget of about 1 trillion tonnes of carbon if we want to keep warming under a 2°C target. Bill McKibben has written about how humans have already used up about half of that budget and that we have already identified (and booked) many more fossil fuel reserves than that budget will allow us to consume. (See also this SEI Discussion Brief by Michael Lazarus.) As the mantra goes: we have to keep most of the reserves in the ground.

Not only do we have to keep the reserves in the ground, but we have a massive fossil fuel resource base and we need to stop converting those resources into reserves, since once we have done that it gets even tougher to keep them in the ground.

Modified from Swart and Weaver, 2012. More details here.

Under any emissions pathway it is almost certain that conventional oil reserves will be produced and consumed. My calculations of the cumulative oil used between 2010 and 2100 for the low-emissions, stay-under-2°C, RCP 2.6 scenario (van Vuuren et al., 2012) is approximately 7800 exajoules (EJ) (approximately 1.4 trillion barrels) Using the reserves estimates for 2005 of Rogner et al. (2012) and adjusting for consumption over 2005-2010, there are as of 2010 approximately 7800-12,000 EJ of conventional and unconventional oil reserves remaining. (In addition to that that there are additional oil resources of more than twice that size.) Therefore, even in the most aggressive mitigation scenario, we appear likely to use up all of the current lower-bound estimate of oil reserves.

Undeveloped unconventional resources, such as the oil sands, are capital-intensive and the economics of new projects are vulnerable to future carbon pricing policies. Established projects with sunk capital will be less vulnerable. If we are to leave carbon resources in the ground, it follows that we should not be encouraging the capital investment that will make it more likely that those resources become reserves and, eventually, emissions.

Although transportation infrastructure, like pipelines, is not the biggest capital investment in the development process, it is a crucial one. They did not call the pipeline "Keystone" by accident.

Proponents of the pipeline often argue that the oil sands crude will find a way to market, regardless of the presence or absence of any single piece of infrastructure. That's arguably true in certain scenarios. Proponents may also claim (as in the State Department report) that invisible hands will take production of lower-cost conventional oil off the market to compensate for the extra bitumen supply. That's also possible. But it is hardly consistent to claim that bitumen will inevitably find its way to market when voluntarily withheld developed and more profitable conventional oil will not eventually find its way to a refinery. That withheld production is for all practical purposes deferred, not cancelled. And as we have seen, it doesn't matter much from a climate-change standpoint when the emissions occur. Economics cares a lot about when, cummulative emissions much less so.

Because of this, it may not matter if production from oil sands projects is offset by immediate reductions in conventional production elsewhere. Over the longer term, that withheld oil will be almost certainly be produced anyway and Abraham’s emissions estimates may turn out to be close to the mark.

Looking only at short and medium-term impacts on a project-by-project basis is an inadequate way to plan for the cumulative global effects of our energy supply. This point was also made in a recent Nature comment by Palen et al (2013). A recent paper by Davis and Socolow (2014) argues that policy makers would be better informed if they adopted a "commitment accounting" method to estimate the cumulative effects of new fossil fuel investments.

Decisions, decisions

The massive capital investments required to start an oil sands production operation are of such a size that they are not—even for the biggest companies—everyday business decisions. Instead, they are strategic moves that could make or break a corporation for decades to come, and they are decisions made in the presence of deep uncertainty.

The big multinational oil company Total recently made the decision to shelve its $11 billion Joslyn bitumen mine project indefinitely. We need not doubt that their publicly stated reason that the costs were too high really was a crucial factor. (That admission, incidentally, rather undermines the argument that oil sands project economics are robust at current prices of $100 per barrel and can comfortably withstand a few extra costs, such as shipping by rail.) However, it is likely that the boardroom discussion pondered other unquantifiable risks, for example: where is the crude oil price headed; what will the light crude/bitumen price spread be; will the price of natural gas rise; how big will carbon pricing be when it is introduced, if ever, and how hard will it hit global demand? There is also the uncertainty over future demand for bitumen from its biggest export market, the United States. Cancelling Keystone XL would be an important signal that the USA neither wants nor needs any more of Canada's bitumen.

If the Joslyn project is never revived, a lot of bitumen will remain in the ground. Total estimated that the mine would produce 160,000 barrels per day. That would take up (allowing for diluent) about one quarter of the capacity of KXL and, using John Abraham's figures, that would lead to saved emissions of around 50 million tonnes of carbon per year. Perhaps the uncertainty over new pipelines can take some of the credit (or blame) for that. Nobody knows, of course, nor can we know what other new projects may be canceled or indefinitely deferred because of doubts about transportation infrastructure.

Northern Gateway and TransMountain, the two pipeline projects that aim to access ports on the Pacific Ocean, face serious legal obstacles and determined local opposition. Pipeline projects to Eastern Canada refineries and ports are planned, but, if the slow and uncertain progress of the other pipelines is a guide, nobody should be expecting them to be completed on schedule, if they are built at all. A CEO of a big bitumen producer is reported as saying that his company needs "every major pipeline project on the drawing board, along with rail, to allow it to transport its growing oil sands production". He won't be getting them all.

Proponents of the development of the oil sands like to point out that expanding the exploitation of the resource will provide significant local economic benefits to Alberta and Canada, while having little effect on global emissions. (Of course, they never frame the benefits in relation to the global economy and they avoid any mention of the significant effect on Canada's future emissions.) It is true that even the highest emissions estimates associated with the KXL pipeline make up not even 1% of global emissions. But it is nevertheless significant beyond its size, not only for climate activists as an achievable objective to rally around, but also as a signpost for nervous potential investors in new oil sands projects. The ultimate impact of the KXL decision on the trajectory of climate change could be far bigger than any calculations of its incremental or even its total committed emissions might suggest.

References

Allen, Myles R., et al. "Warming caused by cumulative carbon emissions towards the trillionth tonne." Nature 458.7242 (2009): 1163-1166.

Davis, Steven J. and Robert H. Socolow. "Commitment accounting of CO2 emissions" Environ. Res. Lett. 9 (2014) 084018 (9pp).

Erickson, Peter, and Michael Lazarus. "Impact of the Keystone XL pipeline on global oil markets and greenhouse gas emissions." Nature Climate Change(2014).

Palen, Wendy J, et al. "Energy: Consider the global impacts of oil pipelines." Nature 510 (2014) 465–467.

Pierrehumbert, R. T. "Cumulative Carbon and Just Allocation of the Global Carbon Commons." Chi. J. Int'l L. 13 (2012): 527.

Rogner, Hans-Holger, et al. "Energy resources and potentials." Global Energy Assessment (GEA), Cambridge University Press, New York (2012): 425-512.

Swart, Neil C., and Andrew J. Weaver. "The Alberta oil sands and climate."Nature Climate Change 2.3 (2012): 134-136.

Van Vuuren, Detlef P., et al. "RCP2. 6: exploring the possibility to keep global mean temperature increase below 2 C." Climatic Change 109.1-2 (2011): 95-116.

Arguments

Arguments

Oil and Gas are very hard energy sources to replace, but coal is the easiest but economically and politically it does not look so easy. For some reason some countries either produce a lot of it or use a lot of it and it employs a lot of people, and makes money for producers and consumers. I always felt that technologically coal was the easiest to replace, its a baseload power source and hence there are lots of suitable alternatives available such as wind, solar, solar thermal, nuclear, tidal, wave and gas etc but as they grow so does demand and globally coal usage is not slowing at the rates needed if at all.

we need to clean up our grids to zero coal or CCS coal.

This issue highlights the reality that the currently developed global financial, industrial, and trade systems cannot be expected to 'lead to the development of a sustainable better future for all'. All signs point to 'something' needing to be done to change what is happening. Yet the decades pass without anything significant being done.

The impacts of the XL pipeline would be irrelevant if it were determined that the Oil Sands are undeserving of being part of the buried hydrocarbons that are allowed to be burned.

It is clear that to develop a sustainable better future there must be a limit on the benefits people can get for themselves in their time. But the system that has developed is all about encouraging the attempts of people to maximize the short-term benefit they can get without a concern for the future, or even a concernb for the current day impacts. The future is an easy target to harm because it has no vote, no buying power, and no legal recourse.

As unpopular and unprofitable and impossible as this may sound one solution would be for the global community to collectively agree to an evaluaton of all the buried hydrocarbons we have located and know how to extract and burn. The evaluation would measure the impacts of each resource per unit of end-user energy obtained for comparison. The impacts would not just be CO2, they would be all impacts. The different resource promoters have already done a lot of the leg-work for the comparisons. All their internal data and their deceptive marketing pitches would contain the majority of the required data. All their information would just need to be evaluated by a team of scientists, like the IPCC. Then the resources could be ranked from least impact per unit of end-use energy obtained and the resources that add up to something like a 1.5 degree C limit would become the resources that can be extracted. And all the resources below that line would be quickly, but rationally shut-in with an expected impact of approximately 0.5 C as they are curtailed bringing the total impact to 2.0 C .

This approach would mean that regions and investors that gambled on benefiting from the high-impact operations that don't make the cut would "lose their bets". Someone has to lose. Those who still have high-stakes gambles on getting away with high-impact actvity deserve to lose. Game-on.

A clarification of what I mean by impacts in my earlier comment. They would include the impacts that currently have no financial value in the marketplace. And the risks of impacts like a pipeline leak or ocean tanker accident also need to be included in the ranking of the differenet resources and how they become end-user energy.

The lack of up-front financial implications for these impacts and risks in the marketplace leads to the development of higher impact less safe ways of doing things because it is cheaper and more profitable to get away with less decent ways of doing things. Some may argue that investors include an assessment of risk of harm. But many of hose investors have proven to be gamblers betting on getting away with their quick early profit and escaping serious personal consequence from a 'future accident' that is no real accident, it was made more likely because of their desire for more quicker profit. That is the reason the free action of everyone in the marketplace is unlikely to properly address this issue.