Carbon - the Huge and Yet Overlooked Fossil Fuel Subsidy

Posted on 11 July 2012 by dana1981

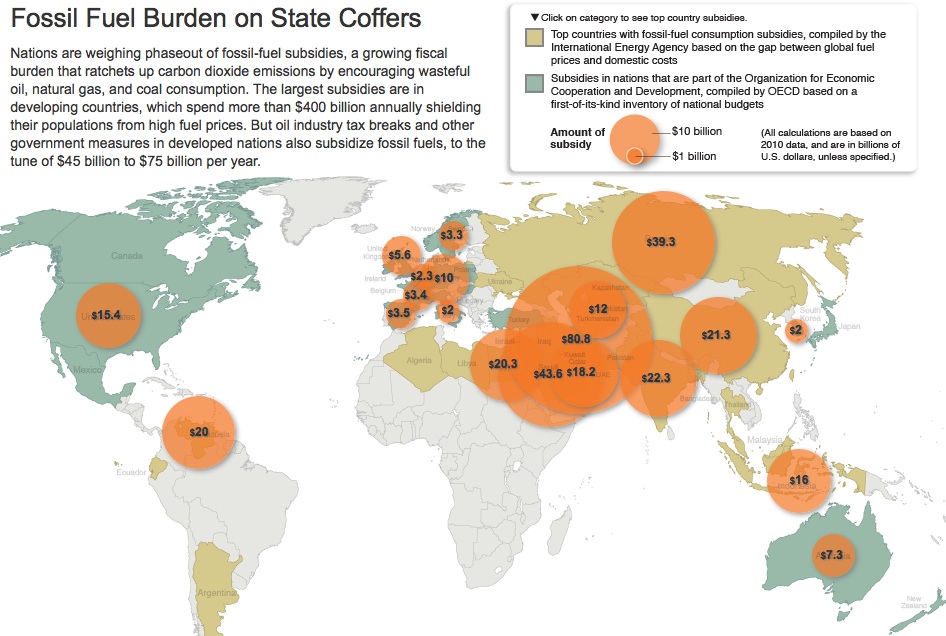

The International Energy Agency (IEA) made headlines recently by concluding that fossil fuels received far more global subisides than renewable energy in 2010. However, it appears that the IEA survey only included data from the countries with the largest fossil fuel subsidies, which are mainly developing countries whose economies largely depend on fossil fuel production. National Geographic's The Great Energy Challenge also includes fossil fuel subsidy data from developed countries (Figure 1), bringing the total global value close to $500 billion for 2010.

Bear in mind that exactly what is defined as a "subsidy" can be rather subjective, so these are just rough estimates.

Figure 1: Global fossil fuel subsidies in billions of dollars per country from National Geographic. Click the image for a larger version, and click here for more information.

It's worth noting that this trend is changing. For example, in the USA in 2011, fossil fuel subisidies in the form of tax breaks were down to $2.5 billion while renewable energy and energy efficiency programs received $16 billion in subsidies. Even many developing countries like Iran (with the largest orange circle in Figure 1 at over $80 billion in 2010 fossil fuel subsidies) dramatically reducing their subsidizing of fossil fuels (in 2011 Iran's subsidies were down to $20 to $30 billion).

Nevertheless, despite the movement in the right direction, global fossil fuel subsidies are still much higher than renewable energy subsidies, despite the fact that fossil fuels and associated technologies have been established for decades to centuries. Fossil fuels also receive another massive subsidy which is rarely taken into account in these types of calculations - carbon emissions.

Social Cost of Carbon

As we know, carbon emissions impact people and our economies through their contribution to climate change through the increased greenhouse effect. The climate change associated with these emissions has a myriad of effects (i.e. rising temperatures, changing precipitation patterns, more frequent extreme weather events, etc.), many of which result in bad effects on people.

It's very challenging to quantify the total dollar impact of these changes, but economists try to estimate the economic damage done by a each ton of carbon (or carbon dioxide) emissions, which they have termed the "social cost of carbon" (SCC). SCC is effectively an estimate of the direct effects of carbon emissions on the economy, and takes into consideration such factors as net agricultural productivity loss, human health effects, property damages from sea level rise, and changes in ecosystem services.

SCC estimates generally range from $5 to $68 per ton of CO2 emitted, though a few more conservative ecoomists put the figure lower, and some economists argue it could potentially be much higher in the near future.

The Huge, Overlooked Fossil Fuel Subsidy

Global CO2 emissions from fossil fuels in 2011 totalled 31.6 billion tons. Given the SCC range of $5 to $68 per ton of CO2, those emissions correspond to a cost of $158 billion to $2.1 trillion per year, globally - roughly $23 to $300 per person. Note that the IEA and National Geographic listed global fossil fuel subisides at $400 to $500 billion. The central estimate of the social cost of carbon emissions is roughly twice that total.

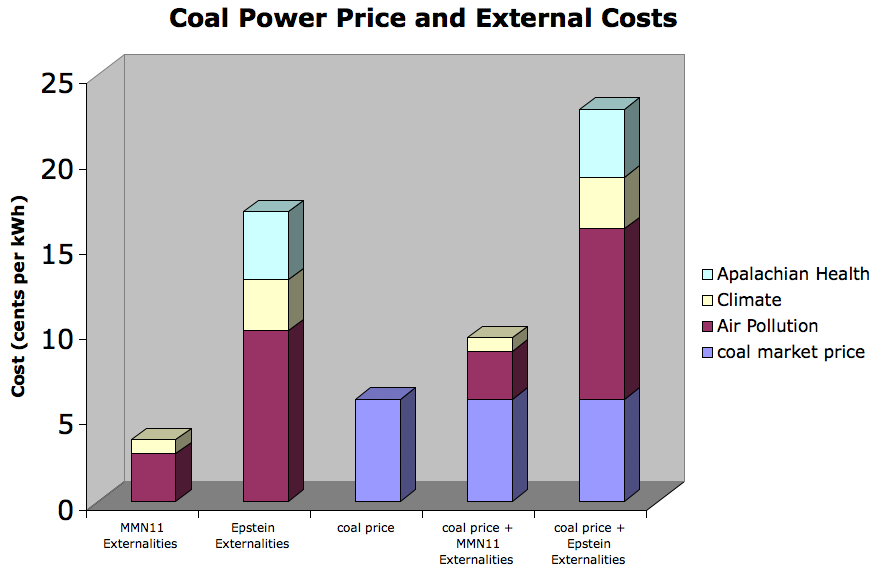

These carbon emissions may reasonably be considered a subsidy because they impose various costs on society (on agricultural productivity, property damage, human health, etc.), but since most countries don't yet put a price on carbon emissions, these costs are not reflected in the fossil fuel market price. Rather than fossil fuel producers and consumers paying these costs, society as a whole picks up the tab. Therefore, fossil fuel prices are kept artificially low (Figure 2), which is generally the purpose of subsidies.

Figure 2: Average US coal electricity price vs. Muller, Mendelsohn, and Nordhaus (2011) and Epstein (2011) best estimate coal external costs.

Fossil Fuel Industries Benefit, You Pick Up the Tab

However, with all subsidies, somebody has to pick up the tab. Usually it's taxpayers who provide the funds to implement the subsidy, but in this case it's everyone who is adversely impacted by climate change, which is basically everybody in one form or another. For example, you pay higher food prices as climate change impacts agriculture (i.e. wheat prices rose as a direct consequence of the 2010 record Moscow drought, heat wave, and wildfires).

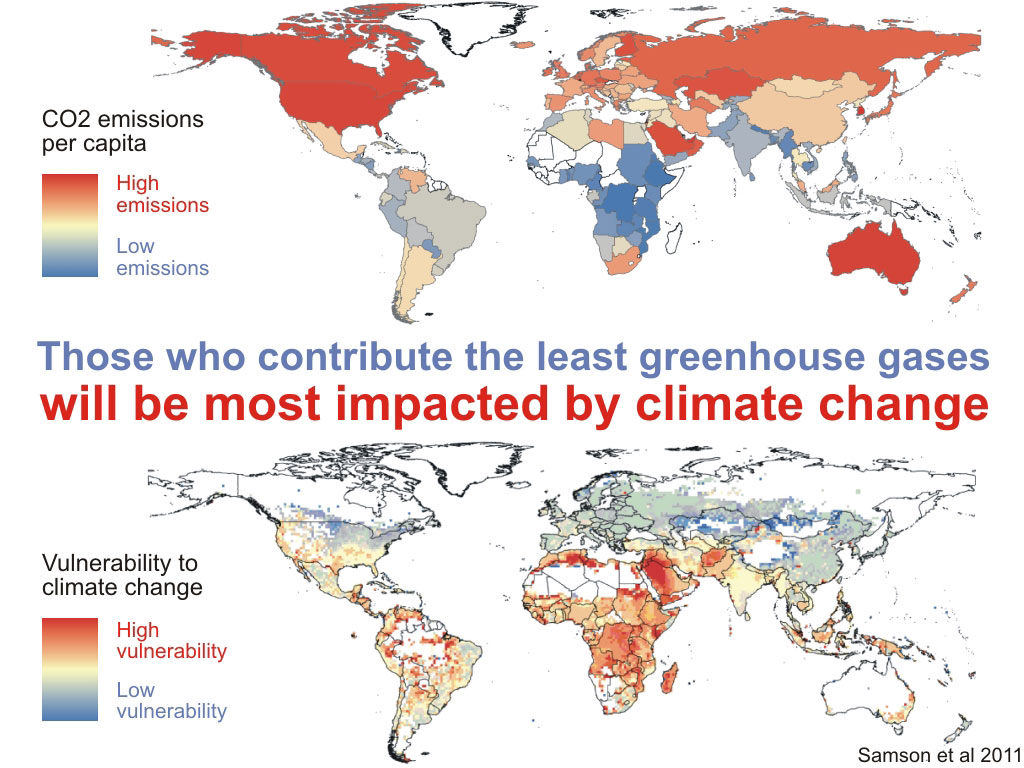

Worse yet, as Samson et al. (2011) showed, the countries with the lowest CO2 emissions will generally experience the largest associated climate impacts (Figure 3).

Figure 3: Top Frame - National average per capita CO2 emissions based on OECD/IEA 2006 national CO2 emissions (OECD/IEA, 2008) and UNPD 2006 national population size (UNPD, 2007). Bottom Frame: Global Climate Demography Vulnerability Index. Red corresponds to more vulnerable regions, blue to less vulnerable regions. White areas corresponds to regions with little or no population (Samson et al 2011).

Carbon - the Forgotten Fossil Fuel Subsidy

It's rather rermarkable that everyone tends to overlook this immense fossil fuel subsidy, which amounts to somewhere in the ballpark of $1 trillion per year at present, globally. It's certainly a difficult figure to quantify with a large possible range of values, but it's also a huge cost which fossil fuel producers and consumers do not directly pay. While the market price of fossil fuels remains artificially low, we all pick up the tab to the tune of approximately $150 per person per year, on average, though those costs are unevenly distributed. However, Economics 101 says that the people who benefit from those emissions (fossil fuel consumers) should be the ones paying their cost through a price on carbon emissions.

Climate contrarians in particular tend to neglect this huge fossil fuel subsidy in two main ways. First, they claim that developing nations need "cheap" energy (a favorite argument of John Christy, for example), when fossil fuel energy is not actually cheap, and in fact poorer nations tend to pay the lion's share of the associated climate costs (Figure 3). Second, they claim that it will be cheaper to adapt to climate change than to mitigate carbon emissions (i.e. Monckton, Michaels and Cato, and the CEO of ExxonMobil have recently made this argument). In this context, "adaptation" means continuing the economic drain of these hundreds of billions to trillions of dollars of fossil fuel subsidies every year, which is several times higher than the cost of climate mitigation.

Most importantly, until we put a price on carbon emissions (and to their credit, a few countries and regions have), fossil fuels will remain extremely heavily subidized at a time when we need to be quickly phasing out our reliance on them.

Arguments

Arguments

0

0  0

0 The issue of fuel taxes is somewhat vexed because they only applies to a limited portion of CO2 emissions.

They do not apply to fuel used in stationary energy generation, for example. In Australia, it does not apply to fuel used on farms or in mines. Because of that you need to have a measure of the emissions of CO2 by combustion of fuel on roads as a portion of all CO2 emissions to determine the value of fuel taxes as a counter subsidy.

What is more, fuel taxes, or a portion of fuel taxes when the tax is very high, can be considered a "user pays" method of funding the road system.

Therefore, to the extent that revenue received is less than the cost of maintaining and upgrading the national highway network, the fuel tax is not a counter subsidy on Carbon. China's fuel tax, for example, is explicitly earmarked for this purpose.

In a similar vane, given the high death an injury rate from road transport, fuel taxes could be in part considered a user pays funding of health care for injuries received from road accidents in nations with social health systems (Europe, Australia, Canada).

Arguably, however, all or most of these costs would exist with a fully electric transport system, in which case the revenue for these services would need to be raised in some other way. On that basis it could still be argued the full fuel tax revenue should be counted as a counter subsidy. Which approach is correct is a matter of convention. It is important to keep these conventions consistent, but it cannot be categorically asserted that one is right and the other wrong.

In any event, the information needed to calculate the level of the "counter subsidy" is not readily available AFAIK. Therefore it would be difficult, and beyond SkS's resources to included them as a counter subsidy. For that reason Dana noted that the definition of a "subsidy" is vague, and that "these are rough estimate". I am glad that you raised the issue so that a more explicit discussion could be made as a caveat on the post.

Having said that, this issue does not detract from the primary point of the post, ie, that the largest "subsidy" on fossil fuels is the hidden subsidy of uncompensated negative externalities.

The issue of fuel taxes is somewhat vexed because they only applies to a limited portion of CO2 emissions.

They do not apply to fuel used in stationary energy generation, for example. In Australia, it does not apply to fuel used on farms or in mines. Because of that you need to have a measure of the emissions of CO2 by combustion of fuel on roads as a portion of all CO2 emissions to determine the value of fuel taxes as a counter subsidy.

What is more, fuel taxes, or a portion of fuel taxes when the tax is very high, can be considered a "user pays" method of funding the road system.

Therefore, to the extent that revenue received is less than the cost of maintaining and upgrading the national highway network, the fuel tax is not a counter subsidy on Carbon. China's fuel tax, for example, is explicitly earmarked for this purpose.

In a similar vane, given the high death an injury rate from road transport, fuel taxes could be in part considered a user pays funding of health care for injuries received from road accidents in nations with social health systems (Europe, Australia, Canada).

Arguably, however, all or most of these costs would exist with a fully electric transport system, in which case the revenue for these services would need to be raised in some other way. On that basis it could still be argued the full fuel tax revenue should be counted as a counter subsidy. Which approach is correct is a matter of convention. It is important to keep these conventions consistent, but it cannot be categorically asserted that one is right and the other wrong.

In any event, the information needed to calculate the level of the "counter subsidy" is not readily available AFAIK. Therefore it would be difficult, and beyond SkS's resources to included them as a counter subsidy. For that reason Dana noted that the definition of a "subsidy" is vague, and that "these are rough estimate". I am glad that you raised the issue so that a more explicit discussion could be made as a caveat on the post.

Having said that, this issue does not detract from the primary point of the post, ie, that the largest "subsidy" on fossil fuels is the hidden subsidy of uncompensated negative externalities.

Comments