Update on BC’s Effective and Popular Carbon Tax

Posted on 25 July 2013 by Andy Skuce

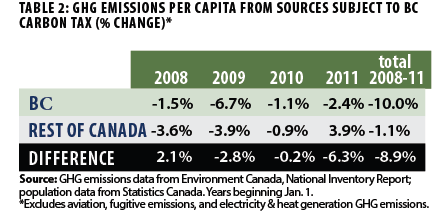

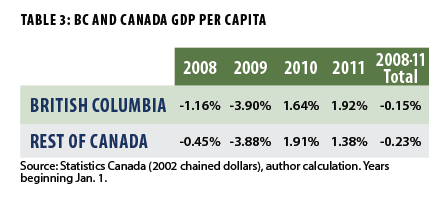

The economic data, which also only go up to 2011, show no big differences in performance between BC and the rest of Canada. The carbon tax was introduced just before the Great Recession hit in 2008 and since then BC has performed only very slightly better than the rest of the country. The significant observation here is that economic disaster has not befallen BC as a result of the carbon tax. The carbon tax is actually slightly better for taxpayers than revenue neutral. The carbon tax revenues have been fully paid back, along with an additional C$500, to individuals and businesses as income tax reductions and direct grants.

The economic data, which also only go up to 2011, show no big differences in performance between BC and the rest of Canada. The carbon tax was introduced just before the Great Recession hit in 2008 and since then BC has performed only very slightly better than the rest of the country. The significant observation here is that economic disaster has not befallen BC as a result of the carbon tax. The carbon tax is actually slightly better for taxpayers than revenue neutral. The carbon tax revenues have been fully paid back, along with an additional C$500, to individuals and businesses as income tax reductions and direct grants.As reported previously, the tax remains popular in BC, with neither of the major provincial political parties having plans to scrap the tax and opinion polls show approximately 64% popular support for it. No doubt, part of the reason for the success is the revenue neutrality, which results in lower income taxes for most BC taxpayers than in any other province, even fossil-fuel-royalty rich Alberta. Repealing the tax would require personal and corporate income tax increases that would almost certainly be very unpopular.

“Revenue-neutral” does not mean—and could not mean—revenue neutral for every individual, it means revenue neutral for the government. People (and businesses) who create more emissions pay more carbon tax than average. The income tax rebates have been focussed on taxpayers earning less than C$117,000 per year, so gas-guzzling plutocrats would be net losers in BC .

Implications for policy makers

Roger Pielke Jr has declared, with some hyperbole, that:

The “iron law” thus presents a boundary condition on policy design that is every bit as limiting as is the second law of thermodynamics, and it holds everywhere around the world, in rich and poor countries alike. It says that even if people are willing to bear some costs to reduce emissions (and experience shows that they are), they are willing to go only so far.

BC has shown that a revenue-neutral carbon tax, set at C$30 per tonne of CO2-equivalent, can be both popular and effective. It is still unclear where Pielke’s boundary condition lies or if there is a boundary condition at all; in any case, it is clearly above $30 per tonne. The popularity of the policy is not because British Columbians, as the stereotype would have it, are all degenerate, pot-smoking lefties.

Well, we are not all lefties, anyway. In the 2011 national election, the percentage who voted for Stephen Harper’s Conservative Party was greater in BC than in Canada as a whole. The provincial government is the right-leaning BC Liberal Party that has won four elections in a row, with two of them since they introduced the carbon tax in 2008.

There are lessons from BC’s experiment that deserve to get the attention of anti-carbon-tax politicians in Ottawa, Washington, Canberra and elsewhere. Carbon taxes can work to reduce emissions without hurting the economy. And if they are designed correctly, they can even help leaders get re-elected.

Added: Prompted by the comments below, I have done some additional work to estimate the effect of cross-border shopping for fuel on BC's fuel consumption figures on my own blog Critical Angle.

Arguments

Arguments

This article makes no mention of the increase in British Columbians driving just across the border in Washington to fill their gas tanks. (http://bc.ctvnews.ca/tax-gap-has-b-c-ers-driving-south-for-gas-watchdog-1.1285011)

According to Statistics Canada, the number of same-day return trips by BC drivers across the US border has increased by more than 100% since the carbon tax was implemented, from 421,665 per month in June 2008 (the last month before the carbon tax), to 868,915 as of May 2013.

Source: Statistics Canada. Table427-0005 - Number of international travellers entering or returning to Canada, by province of entry, seasonally adjusted, monthly (persons), CANSIM (database). (accessed: 2013-07-25)

Yes, carbon taxes will change people's behaviour... thought perhaps not as intended.

Russ R.,

Do you have any data showing the significance of this side effect on the province's overall fossil fuel consuption? I'd guess it just applies to cases where you have very near towns on both sides of the border, quantitatively very marginal.

And even so, it does not invalidate the tool. It just stresses the known downside of doing it in an isolate manner from the neighbour provinces. That's why they have to keep the carbon tax in a low level - even so, with encouraging results.

I'm keeping an eye on this BC experiment, and I think it deserves far more attention than it's had.

Do you guys have plans to add a Facebook "Like" button or Tweet to the articles?

Russ,

that is good observation, but before we get all excited there are a few things to consider. I lived for 5 years in Vancouver (near the airport), the nearest US gas was Point Roberts. This required a round trip of roughly 35 miles in typically brutal traffic. The spread in price had to be large to make it worthwhile to make the trip given that you burned ~10% of your tank and wasted a good 1/2 hour just going through customs. The other driving factor was the USD-CAD exchange rate..

So while there are no doubt people arbitraging the taxes, you have a bit of work to do to show it is a significant fraction of the decreased consumption.. BTW, taking two monthly meausurements ~5 years to define a trend is known to be poor analysis, esp. given that this the SKS website....

You should also be able to correlate it with changes in gas consumption in WA state....

Russ R:

If decreasing greenhouse gas emissions is the goal, then assuming what you describe is a problem worth addressing (which it may not be even if it is a real problem), the solution would be to convince Washington state to adopt a revenue-neutral carbon tax (or equivalent pricing system).

Another thing that has happened at the same time is that the US dollar fell in the decade since 1999. Daily trips Canada-wide were slowly growing beforehand already (except for a giant step down in September 2001). The USD particularly fell in early 2010, which made all goods much cheaper down there. Also, the daily duty-free limit went up recently.

BC's population is particularly close to US population centers, so BC residents can more easily take advantage of the low cost of most goods in the US than can Toronto-area or Montreal-area residents.

tl;dr there's lots of reasons for cross-border shopping to have increased in BC, try harder to show the carbon tax dunnit (or, more precisely, try to tease out how much is due to the new gas taxes).

Alexandre:

That would require data on how many liters of vehicle fuel were "imported" back into BC from Washington, Alaska, Yukon, and Alberta border crossings. I'm pretty sure that no such data exist.

If you'd like a ballpark number, a good place to start would be with the Business Council of British Columbia who estimate that $2.0-2.6 billion in retail revenue is now being lost to cross border visits annually, of which a sizeable amount is gasoline (http://www.bcbc.com/content/879/PPv20n2.pdf). Obviously not peer reviewed, so take with a grain of salt.

From those figures, Willis Eschenbach estimates the imported gasoline volume at around 100 million gallons annually, or more than 50% of the reported reduction in total domestic fuel sales (http://wattsupwiththat.com/2013/07/12/fuel-on-the-highway-in-british-pre-columbia/ and http://wattsupwiththat.com/2013/07/13/the-real-canadian-hockeystick/). Again, grain of salt.

I personally think he overestimates the actual amount due to some aggressive assumptions, but even if he's off by a factor of two, it would still be a significant amount of leakage that should not be ignored, especially since people are burning extra gas (and emitting more GHGs) to realize those cost savings.

I assume you're not from BC, because the distance from the biggest city in the province (Vancouver) to the nearest US border crossing (Point Roberts), happens to be only 25 km (17 miles) from the Oak St. Bridge in Vancouver to the Shell Station in Point Roberts. Traffic is usually terrible, but if you're on passing through the Tsawassen Ferry Terminal (to get to or from Vancouver Island), then Point Roberts is just around the corner.

Russ R @1, from your data source, here are the returning one-day trips in automobiles for Canadian residents only from the US. I assume that Canadians will not fly to the US to fill up their car, nor spend nights away to do so:

The data has been normalized by standard deviation to allow easy comparison of rates of change between provinces.

You will notice that British Columbia (lime green) had fewer such one day trips immediately following the introduction of the carbon tax, although the rate of decline was less than that for other provinces and for Canada as a whole. You will further note that from early 2009 the increased rate of Canadian one day trips is a Canada wide phenomenon, and that the rate of increase in BC is less than that for Canada as a whole. Over the entire period of the Carbon Tax, the trend for BC (0.66 Standard Deviations per annum) is less than that for Canada as a whole (0.72 Standard Deviations per annum), though I do not know whether that difference is significant.

We can conclude from this that the carbon tax is not the cause of the increased day trips to the US from British Columbia, and that if anything, it has reduced the trend to increasing day trips compared to the rest of Canada (but may well have had no influence).

For completeness, the normalized trend for Canada minus BC is 0.7 StDev per annum.

And for additional information, here is the history of the US dollar/Canadian dollar exchange rate:

The similarity to the inverted shape for Canadian one day trips strongly suggests that currency flucuation is the real cause of the changes in Canadian day trip patterns.

The population of BC is approximately 4.4 million. On that basis, an additional 10% of population make day trips across the border, once a month. Assuming that every single one of those day trips includes filling the fuel tank, then we're talking one tank filling for 10% of the population. Assuming that the average person fills a tank approximately once a week, the most that the statistic could account for would be approximately 2.5% reduction in fuel usage in BC. There's still a lot of fuel reduction that cannot be explained on that basis. Now, even assuming that we only fill the tank once a month, there's still a 9% reduction that is not explained by the cross-border traffic. I would be interested to see data that shows the trend clearer, but a cursory view seems to show that the 19% reduction is not explained by filling up south of the line.

Tom,

thx for following up on my skepticism. The exchange rate drives the cross border shopping and one can easily see that in early '09 the CAD went into the crapper (and has subsequently returned)...

Tom Curtis,

Very good presentation of the data in context. I agree with your conclusion, the exchange rate movement is a better explanation for the increase in vehicle day-trips.

However, I would take a bet that on top of doing more single-day trips in general, British Columbians are bringing back more gasoline per cross-border day trip, simply because thanks to the added fuel taxes, the relative price differential on gasoline will have widened even more than the differential on other importable goods.

Russ R @13, as of 2009 (most recent data), BC had 2.6 million light vehicles. They drove an average of 36,000 km per year, or 3,000 km per month. That is equivalent to about four tankfulls a month. In 2009, there were an average of 375,000 one day drive trips to the US from British Columbia, representing 14.4% of all vehicles (assuming for ease of calculation no more than one trip per vehicle). That indicates that approximately 3.6% of all fuel used by BC vehicles was likely purchased on return from a trip to the US, assuming nearly all vehicles did so. Let's call it 4%.

As the trips were for the most part not to get the fuel, and as fuels prices have been cheaper in Washington State than in British Columbia in US$ per gallon for the entirety of the last ten years (and by approximately the same margin), we can assume that that pattern has been consistent through time since before the introduction of the Carbon Tax. The effect of the Carbon Tax is not, therefore, the approximately 4% of fuel used by British Columbia cars that was purchased in the US, but rather the change in that figure. In other words, it is significantly less than 4% of total fuel use on British Columbia roads.

I have no doubt that fuel purchases in the US by British Columbians will have increased by some small margin due to the Carbon Tax. It is not as much as you suppose because the change in the price differential before and after tax is small (to small to pick by eye of a chart). Further, it is not as much as you suppose because US service stations close to the border probably have higher than average prices to exploit the BC market, and BC stations close to the border probably have lower than average prices to claw back market share against US competition. It is certainly much less than 4% of BC fuel use, and hence cannot account for the approximately 20% fall in fuel use* in BC over the period of the carbon tax**.

*Much of that fuel use would be for heating and power generation rather than for transport so it is not strictly comparable. Fuel use for private vehicle transportation may have fallen more or less than that 20%.

**Neither does the Carbon Tax, in that it was already falling before the introduction, although no doubt the carbon tax helped maintain and even accelerate that fall.

Here is the gassbuddy comparison chart for fuel prices between British Columbia and Washington State:

I should have included in the prior post, but plead tiredness and insomnia (the only reason I am posting at this time) as an excuse for my poor composition.

When thinking about cross-border shopping, we have to separate out two different issues:

1) Has the carbon tax, by itself, driven the recent increase in cross-border shopping trips?

Short answer: a bit, but it is probably not the dominant factor.

The carbon tax has added about 8 cents per litre (about 30 cents a US gallon) to the cost of gasoline. A 60 litre/16 US gal fill up across the border would save $5 in avoided carbon taxes. Most BC drivers would burn more money than this in gas just driving to the US and back to fill up. It would take most people at least an hour to do the round trip. So, clearly, few people would be motivated solely by the gas tax to cross the border.

But added to the other incentives to shop in the US, including other taxes on gasoline and cheaper groceries, electronics, booze and cigarettes, the carbon tax adds a small extra incentive.

It is worth noting that cross-border traffic has recently increased in other non-carbon-taxed Canadian provinces also. In addition, the number of border crossing was higher everywhere in the early 1990's than today, which time also coincided with a spike in the value of the Canadian dollar, as Tom noted for more recent periods.

2) Does the recent increase in one-day cross-border trips account for the drop in BC fuel sales?

Short answer: it probably accounts for up to 10% of the measured drop in consumption. But it`s not possible to calculate this exactly.

There were 2.3 million one-day car trips by Canadians between BC and the US in 2007 and 5.7 such trips in 2011. Thats an increase of 3.4 million trips per year. That means that, averaged over the BC population of 4.6 million, there were about 0.74 extra car trips per capita per year. If you assume that the average person fills up a car gas tank 12 times per year and that every extra one-day trip to the US results in a fill up, that would mean about 6% of the fill ups made by BC drivers since the carbon tax was introduced might have been done in the US.

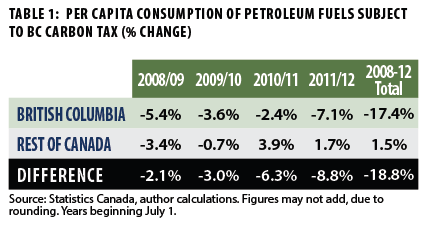

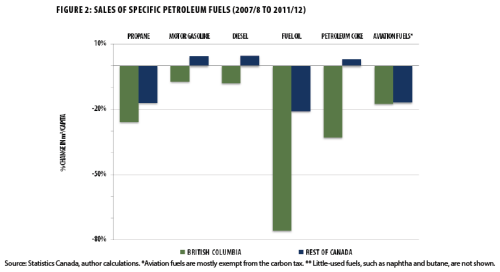

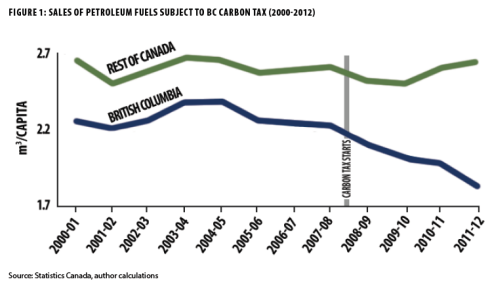

Alternatively, if every one of those extra cross-border trips resulted in an average 60 litre (16 US gallon) fill up, then that makes about 200 million additional litres of fuel purchased annually. On a per-capita basis that amounts to about 44 litres per person per year. The graph labelled Figure 1 in the original post shows that per-capita fuel consumption has dropped by about 0.4 cubic metres per year, or 400 litres per person per year. Therefore, estimated this way, the increase in cross-border shopping would amount to approximately 11% of the drop in fuel sales in BC.

Of course, some extra fuel is consumed in making all of these extra trips, at, let`s say, 8 litres per round trip, that would amount to 27 million litres, so not all of the fuel purchased in the US reduces net fuel sales in BC.

I plan to do a more detailed calculation and I`ll post it on my blog when it is done. I will provide a link here, in a week or so. These are rough calculations only and are dependent on my assumptions, so please treat them as provisional.

Russ R @7

I also pass through Tsawwassen frequently to catch the ferry to Vancouver Island. Although the Shell station in Point Roberts is only a mile or two out of my way, I have never filled up there, partly because I don`t usually carry my passport with me on trips to Vancouver. I note that the gas price at that station is very high by Washington standards, $4.69 a US gallon, probably because Point Roberts is a pene-exclave of the US (that was a new word for me too!) and it's a 35 minute one-way drive (not counting two border crossings) for Point Roberts drivers to get cheaper gas in Blaine WA. And the gas in Blaine is 50 cents per gallon more than in Seattle.

If my Toyota Yaris was 3/4 empty I could buy maybe 32 litres at Point Roberts and save just over $4 compared to gas prices in Victoria. It's not worth the hassle to cross the border twice for that. But if I lived in Tsawwassen and had a Nexus card, I probably would fill up there from time to time.

Tom Curtis,

Again, let me compliment your analysis. I only have a few minor points to add:

1. Your calculation of 14.4% of vehicles doing a cross border day-trip was for 2009, the lowest year in the data set. The number of visits has more than doubled since then. That percentage would be substantially higher today (assuming the size of the BC vehicle fleet hasn't also doubled.)

2. Our analysis has only focused on BC residents buying gas in the US (Washington and Alaska). We've neglected British Columbians driving across the provincial borders, and I have no idea how many of those there would be.

3. We've also entirely neglected the flipside of the coin... a decline in BC gasoline bought by visitors to the province, who instead wait until they get back home before filling up where it's cheaper. (StatsCan also has data for US residents visiting BC by car.)

4. We've ignored multi-day trips. These are probably material because Canadian residents have higher duty-free allowances (especially for alcohol and tobacco) if they've been out of the country for at least 48 hours. Looking back at the StatsCan data, the number of multi-day trips has also approximatly doubled (and yes, the exchange rate is most likely the dominant factor) and these people will also be buying gas.

5. We haven't at all accounted for commercial vehicles... truckers are pretty price sensitive when it comes to fuel, as they have greater fuel capacity and range and will likely have more opportunities to fill up outside the province rather than in it.

My point with all of this is, it's impossible to calculate the magnitude of "leakage" and pretty complicated to even estimate it, but it is obviously a factor (as the lineups at gas stations across the border will attest) and the article makes zero mention of it. They simply assume that 100% of the reduction in domestic fuel sales translates into lower consumption and emissions. Remember, if the tax is high enough to encourage people to change their behaviour and consume less fuel, then it's also high enough to encourage people to buy more of their fuel outside of the province. Both result in lower domestic fuel sales, but only the former results in lower emissions.

I'll close by saying that I'm not at all opposed to the carbon tax, but only because it has maintained its revenue-neutrality. I would probably have distributed the tax rebates differently than BC chose to, but I pretty firmly believe it's more economically sensible to tax consumption than to tax income.

Andy Skuce,

Your estimate of 11% of the reported drop in fuel sales sounds pretty reasonable for BC drivers going to the US. Please see my notes to Tom Curtis above, as there may be other factors you might wish to include in your calculations.

It's also worth noting that starting in 2010 Ontario applied a tax on fuel (and a bunch of other things) amounting to 8% (an even bigger increase than the BC carbon tax), so comparing changes in BC to the rest of Canada isn't a perfectly controlled experiment.

I live in Toronto, and I've certainly been doing more frequent trips to Buffalo. I go for more than just gas, but I routinely fill up my gas tank every time, just before I return.

Russ R @18:

1) I apologize. You are correct. I merely looked for the most recent data without comparing the date to the border crossing data (for which I plead tiredness). Extending the vehicle data back to 2005 (the earliest year with data in html format) to establish a trend, and allowing somewhat crudely for the decreasing trend in new vehicle ownerships, I have recalculated the value for the last 12 month interval as 33%, yielding an approximately 8.3% upperbound on US purchases of BC fuel. Of that some small fraction may be an increase due to the Carbon Tax (but see 6 below).

2) We have indeed neglected provincial border crossings. I have done so based on your contention above that the major population center in BC is very close to Washington State, and ergo relatively distant from provincial borders. Indeed, no major BC city is close to a provincial border, and for the most part they need to cross a mountain range to enter Alberta. I suspect this term can be neglected as well within error of the first term.

3) While we have neglected this term, the usual pattern for people taking a day trip is to fill up before leaving. This must be especially the case when there is a substantial price hike on crossing the border, a pattern that has been the case for at least a decade. Therefore negligible numbers of US citizens entering BC for day trips will started filling up before crossing the border when previously they filled up in BC.

4) As >48 hours requires at least a long weekend, such trips require specific planning and will only occur, for most people a few times a year. Again the impact will be negligible.

5) Again we have ignored this factor, but again the impact will be negligible for similar reasons to those given in (3). IE, the price advantage would already have made this the dominant pattern of behaviour before the carbon tax, and is not likely to have much changed after the carbon tax.

6) This whole discussion todate has been premised on the assumption that the carbon tax made BC fuel more expensive relative to Washington State fuel. I have already alluded to the possibility that this is not the case based on the chart shown @15. In fact, measuring by pixel count at peaks in that chart, I find that there is an approximate 20% fall in the price differential over much of the period post Carbon Tax relative to that prior to the Carbon Tax, although in 2013 prices returned to there former margin. That means prices have moved in the opposite direction to that which you have supposed. Therefore, if anything, over the period of the tax less BC fuel would have come from US pumps than prior to the case, although no doubt for reasons other than the tax. This would have lead to an increase in fuel purchases in BC, rather than a reduction so that we must suppose the Carbon Tax to have been even more effective than we imagined based on naive assumptions.

I would like to confirm this for you with a better statistical method than pixel counting, but gasbuddy charge for the data (and at quite a steep rate). I will note, however, that it is incumbent on people making the argument that changes in cross border fuel purchases have limitted the effectiveness of the carbon tax to provide the relevant data. Given the chart above, and absent an actual statistical analysis of the data, I and anybody else following this excercise would be quite justified in dismissing it as unsubstantiated bullshit.

For what it is worth, there has been a substantial and obvious increase in BC fuel prices relative to Alberta since the introduction of the Carbon Tax, but that is of limited concern given the relative locations of the BC population.

Andy Skuce has drawn my attention to an error in my calculation @14. In fact, in BC 36,000 million vehicle-kilometers were driven, ie, the aggragate of all kilometers by all vehicles 4.5 tonnes and smaller was 36 billion km, not as I had mistakenly interpreted it an average per vehicle of 36,000 km. That means the real average per vehicle was 13, 850 km, or just over 1150 km per month. The net effect is to increase the upper bound of BC fuel purchased from US pumps to 21.6%, if we remember to allow for the additional correction discussed @20.1

This correction has no impact on estimates of carbon leakage, ie, additional fuel purchased outside the taxed area in order to avoid the tax. Because US prices have always been cheaper than BC prices, and because for most of the period of the tax, the price differential has decreased (see @14 {third paragraph} and @20.6 above) there will be effectively no carbon leakage other than a small amount across provincial borders that is severely restricted by population distribution. Nevertheless, it will impact assessments of the tax in another way. Specifically, by reducing the proportion of the BC economy directly effected by the tax, it reduces the effective tax rate by a small (and difficult to calculate) amount. The economic impact would be equivalent to the situation if all fuel were purchased in BC, but the tax rate was X% less, where X depends on the actual proportion of fuel purchased outside British Columbia, and the proportion of fuel expenditure as part of the total economy.

I would like to thank both Andy and Russ for picking up on my errors so that they could be corrected promptly.

Tom Curtis,

I have to say, I was very impressed with your responses right up until that.

I believe the gas price differential between BC and WA, or for that matter between Vancouver and Seattle, indicates that there is little if any economic justification for driving across the border merely to fill the tank. 10 years ago (prior to the carbon tax) the Vancouver price was about 2x the US price, currently it's ~1.5x the US price, and has remained between roughly 1.3-1.5x over much of the last six years.

I see no justification for claiming carbon taxes have driven the BC population to displace significant gasoline purchases, 'carbon leakage', to Washington state. The price differential doesn't support it, and in my opinion more supporting data is needed before accepting such a claim.

Russ R @ 22:

That's odd. When I read Tom saying that, I thought is represented a very succinct summary.

KR,

Let me get this straight... you have no skepticism about a claim that a rougly 7¢ per litre carbon tax is responsible for a huge (18.8%) relative reduction in per capita fuel consumption and are willing to accept it at face value, but you won't accept that some amount of that reduction should be attributed to leakage?

Is that about right?

Russ R @22, in your first post here you cited an article based on information from the Canadian Taxpayers Federation suggesting that a surge in British Columbians crossing the border was due to high tax rates on fuel in British Columbia. Being fair, it may be. The CTF cite high taxes in general, and it was you (SFAIK) who attributed that to the Carbon Tax specifically. Regardless, we now know that the surge is almost entirely a function of changes in the exchange rate, and that the price differential on fuel between BC and WA is at least not unusual, and so cannot be the cause of the surge. In fact the cause is (at least mostly) changes in the exchange rate.

It took about twenty minutes to gather together and present the data to determine that. Nor is it a tricky operation. Normalizing the data involved subtracting from each entry the mean of the column, then dividing by the standard deviation of the column. It is the sort of thing any bright twelth year student could do, and quite a few grade ten students as well. I am certain I could talk my youngest daughter (grade 10), who is currently learning how to use the ANOVA function, through the proceedure in no time flat if she had the slightest interest in the procedure.

So the question is, why did not the CTF do it? By not doing it, the simply took two random facts and combined them to make an argument that was clearly not justified by the data they used. Indeed, with full context, the argument was refuted by the data they used. How is that not an unsubstantiated argument? How is the argument not bullshit when it is refuted by the very data presented as establishing it?

What this episode tells me about the CTF is that they prefer propoganda to understanding. I know this because either they did not do the analysis, or they did. In the latter case they knew the argument was not supported by the data, but presented it anyway in what could only be called a deliberate lie. In the former case, the merely found data that could be construed as supporting their argument, and did not bother checking whether it did or not. The truth of the matter was immaterial to them, at least when set against the imperative of getting their message out.

What it tells me about the CTV British Columbia was that it had a massive failure of editorial standards. A type of failure, I might add, which seems like standard practise for most news organizations nowadays - who again appear to have no concern that what they report is true, merely that it gain viewers or readers.

Despite the apparent moral bankruptcy of the CTF and CTV British Columbia, however, I did not make my statement merely on establishing their original unsubstantiated story was false. It was not until I established that the change in relative prices was opposite to that which might be naively supposed that I insisted that anybody mounting the argument without a proper statistical analysis is spreading sunsubtantiated bullshit. The significance is that that unexpected change in price differential undercuts the logic of the argument entirely. So, we are not in a position of ignorance anymore. We have good reason to believe the fundamental premise of the argument is false. But you still think its OK to spread the argument without any sort of analysis to show the argument is, despite the information we have to hand, still valid? Or indeed, that it is OK to set yourself up as knowledgable on this topic by presenting the argument without having first taken the twenty minutes it requires to check your facts?

Frankly, if that is your approach, I don't care for your good opinion.

I do care about truth, and repudiate utterly the idea that it is OK to ride roughshod over it as a means to an end as the CTF and CTV BC have done in this case.

Russ R. - What I said, and I thought I was being clear, is that given the lack of (and in fact reduction of from 10 yrs ago) differential in gasoline prices, there is little reason to expect significant gasoline purchasing in WA rather than BC. I'll add that the burn of driving to WA from BC would in general lose more than any advantage.

Additional information over and above the lack of economic gain: less increase in day trips to the US from BC than from Canada overall which by itself invalidates the hypothesis, and changes in exchange rate that seem far more likely to be the variable of interest in cross-border travel.

Do some people drive across the border to fill up? Of course - people do all kinds of things for all kinds of reasons. Is it significant as an economic influence? You have presented no evidence to that point, and the economics and travel data say otherwise.

Keep in mind that the carbon tax applies across the board - heating, electrical, industrial, etc. What percentage of the carbon reduction comes from those other sectors, from improved insulation, compact fluorescent lights, and so on? If you want to make a point regarding carbon leakage, find out if (and if so, show your data) whether the carbon tax has displaced electrical generation across the border. But the relative rate of cross-border trips from BC has not increased (it has decreased) relative to Canada overall during the period of the carbon tax, nor for that matter has Ontarios as far as I can see. There's no evidence for fill-up carbon leakage.

You have (IMO) shifted back and forth from multiple data sources in an attempt to support your hypothesis, but (again, IMO) you have not succeeded in producing evidence.

"I'll add that the burn of driving to WA from BC would in general lose more than any advantage"

Let's see, at about 7 cents a liter, the total on a 60 liters tank comes to $4.20, which would buy how much exactly? At $1.45 a liter, that would be less than 3 liters. And how much distance can be covered with that much gas in the kind of vehicle that has a 60 liters tank? 40 km at best in real conditions, perhaps 50 (I think that's overly generous). Therefore, I estimate one would have to be within 18 to 24 km of the nearest station across the border (not the border itself) and avoid long waits to just break even. It would have to quite a bit closer to create a measurable gain and that gain would be so minimal that it becomes problematic to justify the hassle if no other factor is involved in the trip. The cost of mileage for the car (maintenance, tires, oil, etc) should be factored in too.

For anyone in Vancouver with that kind of vehicle, it seems it would be a total no brainer: not worth it. A vehicle with a 40 liters tank capacity and a 30 mpg mileage wouldn't give a much better deal. That's what I can come up with, in 3 minutes by head, based on an outlook from the Washington State side. I doubt that the numbers I'm not aware of (BC gas prices) are so off that they can radically change my conclusion but I'm open to better informed, more accurate calculations.

Tom, KR, Philippe,

I disagree on a couple of points.

One is that I think the data show that BC same-day crossing have gone up faster than elsewhere in Canada. Here's a plot I made. I did running 12 month sums of the monthly data, so the number of cossings is for a yearr centred on a given date.

(Forgive the typo in the label.) The BC same-day trips increase from 2008 to 2012 more in absolute terms than the rest of Canada and in population relative terms much more. As I said above, I don't think this was driven significantly by the carbon tax. I would speculate that this is a result of other pressures and due to the fact that a lot bigger proportion of the population in BC live close to the border compared to other provinces and they can more easily respond to economic incentives by shopping in the US.

But, regardless of the motivation for taking the additional trips, more people filling up in the US in 2012 than in 2008 would depress reported fuel sales in BC, other things being equal. The question is by how much. My provisional estimate is that this may account for a small part (about 10%) of the observed decrease reported per-capita consumption relative to the rest of the country. The decrease reported since the introduction of the carbon tax is huge, 18.8%; if the cross-border-corrected number turns out to be 16%, it would still be a very large decline, far bigger than econometric models would predict from a carbon tax of $30/tonne.

(-snip-).

Rather, all of the skepticism has been directed at the small side-effect of leakage that I raised.

(-snip-).

1. You should maybe have been a bit skeptical about a claim that a ~5% carbon tax resulted in a ~19% decline in per capita fuel consumption. That would imply a long-run price elasticity equal to -3.8. That should have immediately raised a few eyebrows, since no econometric analysis has ever observed a sensitivity figure of nearly that magnitude... the median estimate for long-term fuel (gasoline) price elasticity is only around -0.5. (Source: Gasoline demand revisited: an international meta-analysis of elasticities, Molly Espey (1998) Fig. 2) That implies a ~5% increase in price should result in only a ~2.5% decline in consumption, certainly not ~19%. The authors themselves noted the reduction was 7.1x greater than expected, (-snip-).

2. (-snip-) in 2010, Translink (the public transit authority) raised its vehicle fuel levy by 3 cents per litre, and by an additional 2 cents in 2012 on all gasoline and diesel sales in the South Coast region (covering all of Greater Vancouver) . (-snip-). (-snip-).

3. I suggested that some amount of the massive decline should be attributed to people filling up their tanks outside the province... as a) there is a substantial tax gap, and b) the number of cross-border trips have more than doubled during the period. (-snip-). Never mind that Andy Skuce kindly supported my point @16.2, estimating that around 11% of the decline in domestic sales could be due to cross-border day trips by BC residents. I agreed that his estimate was reasonable, and pointed out @18.2, 18.3, 18.4 and 18.5 that there are at least 4 other smaller factors contributing to the decline in domestic sales, and suggested that he might want to consider them if he's going to be doing more detailed analysis. (-snip-). (-snip-).

4. And then the clincher.... Tom Curtis @15 produced a historical gas price chart he pulled from gasbuddy.com showing that the spread between BC and Washington prices hasn't widened, rather it narrowed as much as 20% by his pixel counting method. And just like that, case closed. (-snip-)... except for one detail. The gas price differential didn't really narrow. (-snip-). Tom (-snip-): "When comparing US cities to Canadian cities you have a choice of price units. The standard unit of measure in the US is dollars per gallon and in Canada the standard is cents/liter. Comparison of US and Canadian cities is done using recent currency exchange rates and uses the conversion factor of 1 US gallon being equal to 3.78 liters." Gasbuddy doesn't apply historical exchange rates. (-Snip-) But nobody here stopped to apply a moment of skepticism (or common sense). News reports of people lining up across the border to buy gas, people complaining of the rising tax gap, 400 thousand more trips per mont... but no... ignore all of those people. Tom concludes that LESS people bought gas because he downloaded a chart that he erroneously interpreted as evidence that the price differential had narrowed. (-snip-).

[DB] Multiple inflammatory tone violations snipped. Please familiarize yourself with this site's Comments Policy and comport future comments to comply with it (link adjacent to the user comment box).

Russ R

i suggest that you read the previous post I made on the subject just a few weeks ago. I addressed points 1 and 2 there, but probably, by the sound of it, not to your satisfaction. Yes there are other gasoline taxes apart from the carbon tax, some of them bigger in the Vancouver area. And yes, the decline in consumption is bigger than expected from what these taxes should produce according to standard models.

You should also read the working paper by Rivers and Schaufele that I linked to that discusses this issue at length. You may be interested to read there that they do not discount entirely the idea that cross-border gas fill-ups may have played a role in the consumption reductions. They wrote:

I understand that a peer-reviewed version of this paper is in the works.

Rather than jump to the conclusion that everyone here is gullible, you perhaps should have considered the possibility that some of us had already thought through some of these issues more thoroghly than you have.

Andy,

I apologize for not having read your previous post.

My rant was not directed at you.

In case you're still in doubt about the gasbuddy.com data, I emailed them to confirm. Here is my email and their response:

I notice that Russ R. is running through the same routine again. That is the routine in which somebody notices that something might be evidence against a particular view. They therefore conclude that it is evidence against that view without bothering with analyzing the data to find out whether conjecture is correct or not. It is a very efficient form of argument in that it leaves all the hard work of analysis to your opponents.

In this case Russ R has identified a factor which may have called into question price comparison data I have already presented. And yes, I accept his claim that international exhange is calculated only at current rates at pricebuddy. But granted that, depending on the pattern of exchange rates that could refute my claim, strengthen it or have no effect. Russ does not know, or at least shows no analysis to indicate one way or the other. The evident reasoning is that this new data may support my argument, therefore it must support my argument.

As it happens, I dislike people being mislead by my mistakes, so I looked into it. I had to download a digitizing program, convert the graph to monochrome so that the program would read it; digitize the data, find a table of exchange rates, and do the analysis. It took considerably more than twenty minutes and I can see why people would prefer to leach of the intellectual labors of others by presenting possibilities as conclusive evidence.

The data compares prices in terms of US dollars per gallon. Therfore I left US prices unchanged. Canadian prices where first divided by the current exchange rate (ie, the value in US dollars per Canadian dollar) to reconvert to original value Canadian dollars. They were then multiplied by the exchange rate to convert the Canadian dollar price into a (contemporary) US dollar price. If anything thinks I have done that wrong, please let me know.

The result:

The trend of the price differential is clearly downward. There is a large jump about the time of the introduction of the carbon tax, but it rapidly falls back to historical levels, and trends further down. The slight recovery at the end still leaves the price differential lower than in 2005.

It turns out that I have made a number of mistakes over the last few days. One I will attribute to tiredness, and the folly of doing analysis as an attempt make insomnia more profitable. The second I will attribute to my unfamiliarity with foreign exchange. In either case, the mistakes are substantive so everything I have written in this thread up to this point should be disregarded, and I apologize for having inadvertently mislead anybody, or for any confusion I have created.

The first mistake I will adress is the most recent. It arose because I confused the symbol USD/CAD as US dollars per Canadian dollar, whereas in forex it has the meaning (apparently) US dollars exchanged to Canadian dollars, ie, the inverse of that which I took it to be. Therefore the chart in post 34 should be as follows:

Clearly the trend in the fuel price difference is rising, and by 6c US per gallon per year. The trend rised faster prior to the introduction of the Carbon Tax (12.7 c per gallon per annum, Aug 2005-Dec 2007) than after (6.9 c per gallon per annum, Jan 2010 to current). Taking the trend from the actual introduction of the carbon tax reduces the trend to 1.8 c per gallon per annum, but that is due to the large spike at the beginning of the period which may be in part an aberration due to misalignment introduced by the digitization process. Regardless, the price differential over the last 12 months was 26.9% higher than that in the 12 months immediately preceding the introduction of the carbon tax, something that would certainly encourage more frequent cross border trips to refuel, and in particular more frequent last stop refueling when returning from the US for other reasons. Therefore, contrary to all that I have said prior to this post, this data definitely supports the contention that there is likely to have been substantial carbon leakage from BC to Washington state.

The second mistake is that pointed out by Andy Skuce @29 above. I'm not sure that mistake is the best word, for I am still convinced my analysis shows that a major cause of relative change in cross border trips is common across all provinces of Canada except New Brunswick (which clearly has a superimposed substantial negative trend). However, by not examining the absolute figures I missed germaine additional information.

First, consider the absolute anomaly in one day road trips to the US across several key provinces:

One thing this shows clearly is that Canada minus British Columbia, when it comes to one day border crossings, essentially just means Ontario. That is not surprising given that they rank third and first in population respectively, and both have major centers of population very close to the US border. Quebec is unusually low in border crossings, but given the francophile nature of quebecoise culture, that is probably not surprising.

More interesting is the anomaly data relative to the period preceding the introduction of the tax, and scaled by SD prior to that introduction:

Just to be quite clear what has been done here, section B of the graph shows each data series (Canada, BC, etc) divided by the mean of that data series from June 2005- June 2008. By doing so, we convert the absolute figures into a direct index of change relative to the pre-tax era. It turns out that BC one day road border crossing have increased by 135.8% (mean of the last twelve months of data) relative to the pre-tax rate of crossings. Section A of the chart then normalizes the data of section B by dividing by the value for Canada less BC. The normalized data for BC shows an increase 2.08 times the rest of Canada (last twelve month mean), showing that approximately half of the cause of the increase is BC specific.

Finally, here is the individual reagional data baselined from June 2005-June 2008, and divided by their standard deviations over that period. It is important that this not be misunderstood as indicating the size of the change. Rather it indicates the size relative to previous variation. The very high values for BC are a factor of the large (150% increase) and the relatively small variation pre-tax.

The very large (13.8 Standard Deviations mean over the last twelve months) indicates clearly that the 150% increase in vehicle crossings is not down to random factors. It has a cause, and the dominant factor, responsible for at least 50% of the increase, is likely to be the Carbon Tax.

For comparison, I have also included the exchange rate data which shows that it is the dominant factor prior to July 2008, but of secondary (or even tertiary) importance thereafter.

So, in summary:

Once again I apologize for my errors, and in particular I apologize to any body who was mislead by them. I further apologize to Russ, whose understanding of the situation has been clearly vindicated. I further withdraw my claims regarding the CTF and CTV BC, which are not justified on the evidence I now have. I to maintain, however, that my comments about the necessity of analysis for justifying an argument is correct. It is, admitedly, much less embarassing, however, when you get that analysis right.

Thanks for the update, Tom.

I'm a little curious how you attributed the increase in border crossings to carbon tax vs exchange rate changes.

An interesting anecdone: I remember talking to a couple we met on the street one evening in Vancouver in 2011 who happened to mention, laughing, that they actually drove across the border to fill up (we'd been discussing how weird it is to live so close to another country — it takes three days of driving just for me to leave my home state!), but in doing so they also pointed out that they lived in the south of Vancouver so it wasn't far to go. They also failed to mention anything about the carbon tax (I didn't even know they had one until reading about it on SkS) and indicated that the'd been doing it for a long time.

It surprises me that a 7c/litre tax would dramatically increase the number of people for whom the trip would be worthwhile; it has always been worthwhile to fill up on the way home to Canada, but to make a special trip just because the fuel is cheaper? On the other hand, I recall the Canadians were very chuffed at the time (or possibly during the 2009 trip, I forget) about the appreciation of the C$ against the US$, and that I can imagine being a big driver in making cross-border shopping trips a lot more worthwhile, especially since domestic prices in the US seem to be almost completely immune to exchange rate fluctuations.

I can see that you're comparing BC with other provinces, but I wonder if that could simply be due to the very close proximity of the major population centre to the border making those cross-border shopping trips relatively more attractive to a larger percentage of the population vs other provinces?

Regarding the historical fuel price comparisons, you probably need to focus on prices at petrol stations close to the border; I doubt anybody would go all the way to Seattle just to get fuel and I expect the price of petrol will rise the closer the station is to the Canadian border.

Just in case you (or Russ) has got nothing better to do. :-)

JasonB@36

You are correct about the Washington gas prices being higher in border towns than in Seattle. The last time I looked, a couple of days ago, the USD per gallon prices in border towns were: Sumas $3.91; Blaine $4.07 and; Point Roberts $4.69 (cut-off by direct road link to the rest of the US). Seattle prices were $3.55. All of which goes to show that American retailers know how to take a profit on the other side of an arbitrage opportunity.

The cross-border gas price problem also points to the limits of unilateral carbon taxes in the context of free trade. Border tarriff adjustments will probably be needed eventually if one side of a trading partnership adopts a carbon tax and the other does not. My understanding is that this might be allowed under WTO rules (unsurprisingly, legal opinions differ), but that this would not be allowed (or practicable) under NAFTA, the N American free-trade agreement.

I agree that part of the relative increase in BC cross-border shopping is due to the proximity of the border and the toll-free ease of crossing it. All of the Southern Ontario border crossings involve bridge tolls. It would be interesting to see what happened to cross-border traffic if a border-crossing fee were to be imposed by the US government. It is unkikely that this will happen, due to pressure from US merchants in northern border states.

Tom@35

I appreciate you making those corrections. Thanks!

So, this fascinated me, including the continuing claims of Russ R regarding people buying gasoline in Washington State. So, I decided to get some data. For one thing, I grabbed Excise Tax reports from Washington State, nicely available because of their transparent government, and cross-checked these with other sources. I was able to obtain, for State of Washington, total number of gallons sold in the period of interest.

These data were found at:

http://dor.wa.gov/

and

http://www.eia.gov/

and

http://www.eia.gov/tools/faqs/faq.cfm?id=26&t=10

In short, unless one has evidence that the total number of British Columbia people coming into Washington State to buy is totally negligible compared to the population buying in Washington State, with 4.4 million people in B.C. and 6.8 in Washington State, or significantly diminished because of the distance they travel, there is no evidence that the number of gallons of gasoline sold has jumped because of border crossings. Then, again, the idea that the decrease in gasoline use reported by B.C. government is due to cross-border raids is not supported by this data.

The same kind of calculation could be done for Alaska, but I don't know why people's behavior in B.C. would be different if they live against one border than another.

[RH] Fixed excessively long URL's. Also created image for data table since that was breaking page formatting too.

Another article about the new study cited in the OP :

'Sky didn't fall' after British Columbia lowered income tax, dropped fuel use with carbon tax by Coleen Jose, ClimateWire, E&E Publishing, July 30, 2013

More on the BC Carbon Tax

The Economist

Mark Jaccard and another article discussing how carbon tax revenues should be spent.

Dana's Guardian blog

I've been arguing about this in another forum:

Climate Change - Impacts Part 2

The opposing argument against the info I posted from SkS are as follows:

1) while BC is keeping pace with the rest of Canada, it was doing better before 2008:

BC Carbon Tax Damage

2) it's unlikely that a few cents' tax had such a dramatic effect on consumption:

BC's carbon tax has had little effect on fuel consumption

3) in 2014, gas consumption in BC is back up to where it was in 2008:

No B.C. carbon tax miracle on 120th St.