The latest global warming bill and the Republican conundrum

Posted on 25 November 2014 by dana1981

Senators Sheldon Whitehouse (D-RI) and Brian Schatz (D-HI) introduced a climate bill in the US Senate last week. The American Opportunity Carbon Fee Act proposes to tax carbon pollution at the source or at the border for imports, and return 100% of the revenue to taxpayers. The tax would therefore be revenue-neutral, not increasing the size of government.

A revenue-neutral carbon tax has become an increasingly popular proposal for tackling global warming. Liberals have long been on board with requiring that polluters pay for their carbon emissions, but in the United States and a few other countries where climate science is treated as a partisan issue, conservatives have been resistant to this concept.

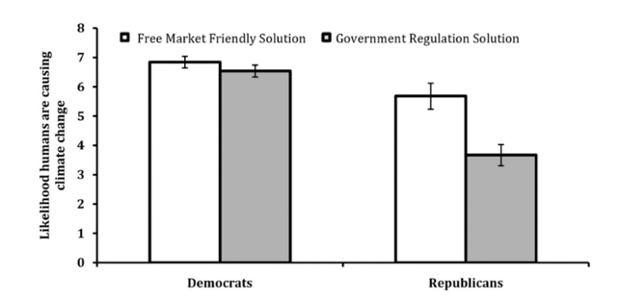

Research has shown that fear of government regulations is one of the primary reasons conservatives tend to reject the overwhelming scientific evidence for human-caused global warming. A majority of Republicans accept the scientific reality when they realize there are free market solutions available.

The American Opportunity Carbon Fee Act is a free market solution that, because it’s revenue-neutral, wouldn’t increase the size of government. All of the revenue generated would be returned to taxpayers through a variety of possible paths:

- Economic assistance to low-income families and those residing in areas with high energy costs

- Tax cuts

- Social security benefit increases

- Tuition assistance and student debt relief

- Infrastructure investments

- Dividends to individuals and families

- Transition assistance to workers and businesses in energy-intensive and fossil-fuel industries

- Climate mitigation or adaptation

- Reducing the national debt

Senators Whitehouse and Schatz are willing to negotiate these various options with Republicans. However, the bill faces a tough road. Many free market carbon pricing bills have been proposed in both the US House of Representatives and Senate, and none have been voted into law. For example,

- Lieberman (I-CT) McCain (R-AZ) 2007 - The Climate Stewardship and Innovation Act

- Lieberman (I-CT) Warner (D-VA) 2007 - America’s Climate Security Act

- Waxman (D-CA) Markey (D-MA) 2009 - The American Clean Energy and Security Act (ACES)

- Kerry (D-MA) Lieberman (I-CT) 2009 - The Clean Energy Jobs and American Power Act

- Sanders (I-VT) Boxer (D-CA) 2013 - The Climate Protection Act

- Van Hollen (D-MD) 2014 - The Healthy Climate and Family Security Act

The first four bills listed above proposed carbon cap and trade systems. Boxer-Sanders proposed a carbon tax, but one that’s not revenue-neutral. Van Hollen introduced the first revenue-neutral carbon cap and trade system.

ACES was the only effort to come close to becoming law. It passed the House of Representatives in 2009 by a vote of 219–212. The Senate version (Kerry and Lieberman’s Clean Jobs and American Power Act) had a majority of votes, but not the 60-vote super-majority needed to break through a filibuster.

Despite the failed history of climate legislation in the US Congress, Senator Whitehouse is optimistic about his bill’s chances for two main reasons. First, he feels that since Republicans control both houses of Congress for the first time since 2006, they can’t just continue their strategy of obstructionism from the minority. They’re obligated to get something done, especially if they want to maintain control of the Senate in a 2016 election with a map far more favorable for the Democrats than in 2014.

Second, the Environmental Protection Agency is proceeding with its regulation of carbon pollution from power plants. Republicans hate this government regulation, and the Whitehouse-Schatz bill is designed to potentially replace it with a free market, small government alternative. Passing a climate bill in Congress is Republicans’ only realistic shot at eliminating the government regulation of carbon pollution.

It’s also important to remember that John McCain, the 2008 Republican presidential candidate, authored a major climate bill just five years ago. Climate change hasn’t been a purely partisan issue in the GOP for very long, so perhaps the party could change tracks relatively quickly and start treating the issue with the seriousness it needs and deserves once again.

The Whitehouse-Schatz bill is nevertheless a long shot. For example, Senator David Vitter (R-LA) responded to the proposed legislation by saying,

It’s not just energy prices that would skyrocket from a carbon tax, but the cost of nearly everything built in America would go up. And let’s not lose sight of how big of a dud cap and trade was in 2009, or as it came to be known — cap and tax. For some reason Democrats continue to ignore what a disaster these ideas have been for Europe.

Senator Vitter’s objections are not strong ones. While a carbon tax would raise energy prices, that increase would be offset when the revenue is returned to taxpayers. Analysis of a similar revenue-neutral carbon tax proposal found that it could increase personal disposable income in most parts of the America and thus create jobs and modestly benefit the US economy.

Senators Whitehouse and Schatz aren’t proposing a cap and trade system, but the 2009 legislation mentioned by Senator Vitter was no dud; it came within a few votes in the Senate of becoming law. The European Union also implemented a cap and trade system, not a tax. While the system has had its problems, Europe produces much less carbon pollution than the United States, while its economy has done equally well since the cap and trade system was launched in 2005.

Senator Whitehouse is right that his bill probably has the best chance to become law of any climate legislation proposed in the past five years.

Arguments

Arguments

Republicans have boxed themselves in. They have no other choice but to repeal the Laws of Thermodynamics.

XRAY1961 - mouseover for magnifier, or just click on it to see it in its original context.

As an American I have always found it interesting that Liberals treat the environmently conservative while the so-called Conservatives liberally pollute everything (they can get away with) in sight

Can anyone explain why Conservatives make the worst Conservationists?

I once called myself an Environmentalist until Conservatives made that a 'dirty word' so I started calling myself a Conservationist but they (unintentionally) made that a 'dirty word' also just by their Brand and besides Conservation simply is no longer enough so now I call myself an Environmental Restorationist

Let's see them try to twist and screw that up .....

Wanna see a Republican become a Raving Socialist? Just try to close an Army base or Defense manufacturing plant in their area ...... Suddenly those Government Jobs that are entirely Socialisticly Funded (100% government/tax funded) are the best thing since sliced bread .... And even Unions look good to them in this environment (pun intended)

I'm all for this bill, and am personally ok with any of the spending provisions in it, but describing it as "revenue-neutral" is a bit disingenuous. Some of the provisions, such as lowering tax rates could reasonably be considered "revenue-neutral" in that sense, as the tax cuts would mean less revenue from other taxes offsetting the new revenue (like British Columbia's carbon tax); but spending it on infrastructure or reducing the national debt, and you're really just bringing in new revenue and spending it. Without tax-cut offsets elsewhere, bringing in that new revenue and spending it would be "deficit-neutral", but if the government is getting more revenue than it otherwise would from this bill, it definitely isn't revenue-neutral... and that is the biggest sticking point among conservatives that I have discussed carbon taxes with. If you're taxing their carbon and not cutting their taxes elsewhere, you're just raising their taxes overall for new spending.

phaeretic @5 - it's intended to be revenue neutral, but whether that's true depends on how the revenue is ultimately returned to taxpayers. I agree, reducing the debt for example isn't really revenue neutral, but it's thrown in there as an option to get Republicans on board. If Republicans want it to be revenue neutral, then it will be.

The only way Republicans care about reducing the debt is by cutting spending on existing programs. Reducing the debt by increased revenue through a new carbon tax is total anathema and I'd be shocked if it brought a single Republican on board. And the conservatives I've discussed carbon taxes with, find it totally laughable to consider debt reduction, as well as many of the other provisions in this bill (like infrastructure investments or climate mitigation) to be revenue neutral, let alone instances of 'returning the money to the taxpayers.'

I agree that the bill has the potential to result in a truly revenue-neutral implementation as written, and it is obviously a starting point for negotiations, but the bill, as written, is just as easily and legitimately described as a tax increase to pay for new spending as it is to describe it as "revenue-neutral", and that makes it a lot harder to sell.

I strongly agree with your take Phaeretic. True revenue neutral would return a check to each person in the US, on a per capita prorated basis: Done. However, as a liberal I do like the various options offered. I'll take it anyway it comes. We must take strong action ASAP, and a carbon tax is an excellent, effective, and efficient process.

This is very hopeful news! If something like this could really take off, my sour mood would turn a mighty shade brighter. ... But, Dana, when I read the bill, to me, it doesn't read singularly revenue-neutral as in ONLY providing dividends to individuals with the collected revenue (page 25, row 19 seems to be buried among other expenditures).

Personally, I am all for good & effective use of these funds (as it is written sounds good to me), but to get it thru this anti-science GOP caucus, it seems to me that 100% of expenditures have to be only toward individual dividends. Only then (except for a ~5% administration cut), anyone that called this a tax increase (i.e. meaning net positive dollars going into governmental coffers) would be speaking fraudulently. ... If so, then, the GOP could not even use its "no tax" platform for defense of its obstruction. Well, they could (& would), but they would be fraudulent.

[JH] The use of "all caps" constituters shouting and is prohibited by the SkS Comments Policy.

Sauerj,

5% is not required for administration. Less than 0.1% is more the mark. The Social Security administration has low administraiton costs and for fee and dividend it would be lower since qualifying is easier.

Thanks Michael. You are most undoubtedly right. I was only guessing conservatively to the extreme (which usually is best to win the greater argument), based on that the best charity organizations operate in the 5% admin range. But in this case, it makes sense that the % cut would much lower due to the sheer vast volume of money at hand. ... Sorry for the all caps, didn't realize about this rule and didn't mean to shout but only make my meaning clear ... won't do it again (hopefully I'll remember thru my final ~twenty years; expect this site to age honorably into the future hallows of tomorrow). ... Regards!

[JH] Point of clarification: The "no all caps" rule does not apply to acronyms.

British Columbia's experience with a revenue-neutral carbon tax is that the extra administration costs are very small. Most fuels are already measured and taxed at the point of sale and the rebates and dividends can be paid through the existing income tax administration.

One important feature of a carbon tax that is defined in its legislation as revenue-neutral is that repealing it will cause an income and corporate tax increase. This dis-incentivizes conservatives from scrapping it. Maybe Tony Abbott would have thought twice about getting rid of Australia's carbon tax, if that had triggered an immediate income tax increase.

I would not say this bill qualifies under the definition of revenue neutral. It would be hard enough to get a bill passed that just says: "All revenue shall be paid out in reduced earned income and Soc. Security tax." Instead this bill has all sorts of other provisions: Page 24 of the pdf at http://www.whitehouse.senate.gov/download/?id=5a0a5234-a651-4e50-a4b5-2b15a7e57d3a&download=1 says the funds can be paid out in various ways. Only (b) and (i) are clearly revenue neutral. (a), (d), (e), (g), and (h) are clearly payouts to special interests and are by definition not revenue neutral.

‘‘(A) Providing economic assistance to low income households or households in regions 5 with disproportionately high energy costs.

‘‘(B) Transfers to the general fund of the Treasury to offset tax cuts.

‘‘(C) Transfers to the Federal Old-Age and Survivors Trust Fund and the Federal Disability Insurance Trust Fund established under section 201 of the Social Security Act to provide supplemental funding for increases in Social Security benefits.

‘‘(D) Providing tuition assistance for higher education or alleviating federal student loan debt.

‘‘(E) Investing in improvements to the infrastructure of the United States.

‘‘(F) Providing dividends directly to individuals and families.

‘‘(G) Providing transition assistance to workers and businesses in energy intensive and fossil fuel industries.

‘‘(H) Investing in mitigation and adaptation measures that promote national security, protect public health, conserve natural resources, or fulfill international climate commitments made by the United Nations Framework Convention on Climate Change.

‘‘(I) Reducing the debt of the United States.