The Ridley Riddle Part Three: Like a Northern Rock

Posted on 12 August 2011 by Andy Skuce

This is the third and final article in the series on climate contrarian Matt Ridley. Here are Parts One and Two.

This article will look at Matt Ridley’s involvement in the collapse of the British bank, Northern Rock, in 2007. I am not the first to attempt to link this business disaster with with his views on climate change; George Monbiot wrote an article, The Man Who Wants to Northern Rock the Planet, remarking, among other things, on the contradiction between Ridley’s small-government libertarianism and his begging the Treasury for a bail out of his company.

The rise and fall of Northern Rock

Matt Ridley was the non-executive Chairman of Northern Rock, a British bank that, in 2007, was the first in over a century and a half to experience a run on its deposits. British banks had all survived two World Wars, the Great Depression, and the end of the British Empire, until Northern Rock failed. Ridley had served on the Northern Rock board of directors since 1994 and was appointed Chairman in 2004. A previous Chairman of the bank was his father, Viscount Matthew Ridley.

Northern Rock’s depositors responding rationally but not optimistically to market signals. Source

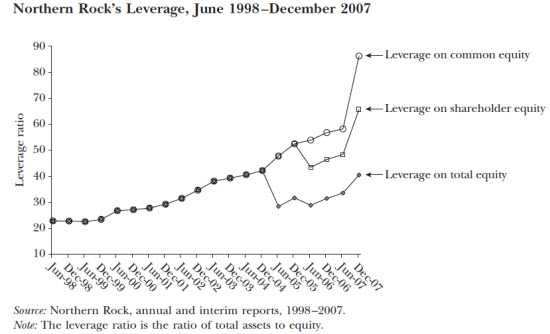

Northern Rock’s business model was a very aggressive one, centered on rapid growth of its mortgage business. Before 1997, Northern Rock was a building society, a co-operative savings and mortgage institution. Like many other British building societies, it transformed itself into a bank and was listed on the stock exchange. This led to rapid growth for Northern Rock, which grew its assets at an annual rate of more than 23% from 1998 to 2007. Before its crisis, Northern Rock had assets of about $200 billion and was the fifth-largest bank in Britain. The bank’s retail deposits did not grow at the same rate as its mortgage assets; the difference was made up with funding from capital markets. When the credit crisis hit in 2007, Northern Rock saw its funding vanish. Northern Rock’s debts were more than fifty times its shareholder common equity, making the bank an outlier even among the many other highly-levered financial institutions at that time. This made the bank particularly vulnerable to changes in the credit markets. The bank was unable to pay its creditors and had to turn to the Bank of England for help in September 2007. These events led to panic among its depositors, who formed huge queues outside its branches to withdraw their savings.

No one saw it coming?

A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional way along with his fellows, so that no one can really blame him. John Maynard Keynes, 1931.

One month after the bailout of Northern Rock, there was an inquiry by a UK Parliamentary committee at which the senior Northern Rock managers were subjected to a grilling. The entire minutes of the session are interesting to read; here’s a short excerpt:

Q404 Mr Fallon [Treasury Committee, Conservative Member of Parliament]: But a heavily leveraged bet on the movement of interest rates and on capital markets remaining open for an over-exposed model like this seems to me a fairly basic banking error, is it not?

Dr Ridley: We were subject to a completely unpredicted and unpredictable closing of the world credit markets. Our model was entirely transparent to the market and to the regulator. It was discussed regularly with both and it was not at the time seen as running a particularly high risk in terms of liquidity.

Q405 Mr Fallon: But it was your duty as Chairman and as a Board to ensure that your bank was liquid.

Dr Ridley: We reviewed liquidity regularly and we reviewed our policy on liquidity and our policy on funding regularly.

Q406 Mr Fallon: But you were wrong?

Dr Ridley: We were hit by an unexpected and unpredictable concatenation of events.

Q407 Mr Fallon: So you are the Chairman of a bank that ran out of money and that caused the first bank run in this country for 150 years; you have had to borrow billions of pounds of public money from the Bank of England; you have damaged the good name of British banking; why are you still clinging to office?

Yet, the events leading to the credit crunch, the bursting of the housing bubble and the collapse of financial markets, were not entirely unforeseen, especially by commentators outside the banking sector. Table 1 in this article, for example, lists eleven separate warnings from academics and analysts. In 2006, Robert Shiller of Yale University wrote: "there is significant risk of a very bad period, with slow sales, slim commissions, falling prices, rising default and foreclosures, serious trouble in financial markets, and a possible recession sooner than most of us expected.” The specific case of Northern Rock’s exposure was clear to at least one financier, Australian John Hempton, who, in 2005, wrote:

If you grow risk by 25 per cent and profits and capital by 15 then either you will run out of capital and the regulators or rating agencies or bond markets will not allow you to fund your growth – in which case the growth fizzles out at best, or you will eventually be taking so much risk that the return on capital will not be rational in an ex-ante basis. Some point ex post you will blow up, possibly spectacularly.

Crucially, the credit markets knew very well that Northern Rock was an exposed outlier, which led to the company being the first among all the British banks to fall.

According to Shin (2009), the common equity leverage of US investment banks in mid-2007 was in the range 25-30. The final uptick of the hockey stick graph after June 2007 was caused by the share price collapse in the Fall of 2007.

Perhaps any warnings of a housing bubble were dismissed in the boardroom as model-based speculation; perhaps cautions about unsustainable growth were said to be unduly alarmist; perhaps even hockey-stick graphs showing Northern Rock’s growing leverage were scoffed at as being statistical artifacts; anybody silly enough to speculate that liquidity risks could lead to a bank run would have been laughed out of the boardroom. However, as events unfolded, Northern Rock’s shareholders, creditors, customers, and the British taxpayer would surely have concluded that their interests would have been better protected had there been a few rational pessimists on the Northern Rock board of directors.

Motes and beams

Matt Ridley has been highly critical of the IPCC reports and of the Chairman of the IPCC, Rajendra Pachauri, mainly for the overblown stories about the Himalayan glacier typo and the poorly-referenced but correct accounts of the Amazon Basin’s vulnerability to drought. Yet for all the accusations that the IPCC has exaggerated impacts of climate change and “sexed-up” summaries for policy makers, its track record is solid compared to the rosy business outlook that Ridley portrayed in the Northern Rock Annual Report 2006, and published in early 2007, just a few months before the company failed.

Two senior officers of Northern Rock—the Deputy Chief Executive and the Managing Credit Director—were heavily fined in April 2010 by the UK Financial Services Authority for hiding the decline in the performance of the company’s mortgage assets in early 2007. There’s no suggestion that Ridley played any role, or, at the time, was even aware of this misrepresentation of important financial data. All the same, the transgressions happened under his watch as Chairman and, as far as I know, he has not since expressed any regret for the incident. Nevertheless, a few months after his former colleagues had been sanctioned, Ridley had the audacity to write an article for the Times in which he referred to the “discredited Dr Pachauri” in “shut-eyed denial”. Yet none of the contributors to Chairman Pachauri’s reports has ever been shown to have deliberately misrepresented any data.

Comes before a fall

When you view Ridley’s TED talk When Ideas Have Sex, there’s no doubt that he is a passionate communicator of the idea that David Ricardo’s theory of comparative advantage was a major driver of human cultural development over the past 100,000 years. And when you read the Chairman’s Statement for the 2006 Northern Rock Annual Report, he expresses genuine pride in reporting not only the financial results of the company, but also the company’s generous support of the charitable Northern Rock Foundation. Matt Ridley is not greedy, he is an idealist. When you read The Rational Optimist, it’s clear that he’s not at all indifferent to the future, but the ideological lens through which he views the world distorts and obscures some things as much as it brings others into focus. In the Introduction to The Rational Optimist, Ridley writes a paragraph about Northern Rock, which concludes:

But what made the bubble of the 2000s so much worse than most was government housing and monetary policy, especially in the United States, which sluiced artificially cheap money towards bad risks as a matter of policy and thus also towards the middlemen of the capital markets. The crisis has at least as much political as economic causation, which is why I also mistrust too much government.

Even though Northern Rock freely chose to gather up, with both hands, all of the cheap money from the middle men of the capital markets that it could, for as long as it could and to a greater extent than its competitors did, for Ridley, the lesson of the crisis is that it was the government's fault. Even after the business disaster that he presided over, Matt Ridley’s avowed Rational Optimism has not been tempered by the experience. He asserts, contrary to the facts, that the "concatenation of events" that hit Northern Rock was "unexpected and unpredictable", while having the hubris to claim, based on his prejudiced assessment of the science, that:

Over the past few years it has gradually become clear to me that climate change is a nosebleed, not a severed limb, and that the remedies we are subsidising are tourniquets round the neck of the economy.

From the Northern Rock 2006 annual report.

For Ridley, in business as in climate, prudent precautionary measures are rejected as ruinous, whereas warnings that real disasters may be lurking are dismissed. As the Northern Rock experience showed, being dazzled by the power of virtuous circles can blind you to the fact that, if spun too hard, they can quickly turn vicious.

Arguments

Arguments

0

0  0

0

Comments